Theory Base Of Accounting

Accounting Principles:

Accounting statements disclose the profitability and solvency of business to various parties. It is necessary to prepare such a

statement in a standard language following a standard set of rules and regulations. These rules are known as “Generally Accepted

Accounting Principles” or GAAP.

Basic Concepts:

Theory Base of Accounting concepts are fundamentally the basic ideas holding the theory base of accounting and therefore, can

be regarded as general working practices for all accounting activities. These concepts are mentioned below:

1. Business Entity Concept: This concept assumes that a business, has a distinct and separate entity from its owners. Thus, for the

purpose of accounting, a business and its owners are to be treated as two separate entities.

2. Going concern concept: As per this concept it is assumed that the business will continue to exist for a long period in future and the

transactions are recorded in the books of business on the assumption that it is a continuing enterprise.

3. Consistency concept: It states that accounting principles and methods should remain consistent from one year to another. It helps

them to compare the profit and loss of different periods and draw meaningful conclusions.

4. Accrual concept: As per this concept revenue is recorded when sales are made, and it is immaterial whether cash received or not and

same applies to expenses also. It provides more appropriate information about business enterprise as compared to cash basis.

5. Matching Concept: The concept of matching emphasizes that expenses incurred in an accounting period should be matched with revenues

during that period. It follows from this that the revenue and expenses incurred to earn this revenue must belong to the same accounting period.

6. Cost Concept: The cost concept requires that all assets are recorded in the book of accounts at their cost price, which includes the cost of acquisition,

transportation, installation, and making the assets ready for use.

7. Objectivity concept: This principle of accounting specifies that the transactions should be recorded in an objective manner and should be unbiased

in nature.

Systems of Accounting:

There are two systems of recording business transactions which are following:

1. Double EntrySystem: This system is based on the principle of “Dual Aspect” which states that every transaction has two effects, viz. receiving

of a benefit and giving of a benefit. Each transaction, therefore, involves two or more accounts and is recorded at different places in the ledger. The

basic principle followed is that every debit must have a corresponding credit. A double-entry system is a complete system as both the aspects of a

transaction are recorded in the books of accounts.

2. Single Entry System: This system is not a complete system of maintaining records of financial transactions. It does not record the two-fold effect

of each and every transaction. Instead of maintaining all the accounts, only personal accounts and cash books are maintained under this system. The

accounts maintained under this system are incomplete and unsystematic and, therefore, not reliable.

Basis of Accounting:

1) Cash basis:

Under this entries in the books of accounts are made when cash id received orpaid and not when the receipt or payment becomes due. For example, if

salaryRs. 7,000 of January 2010 paid in February 2010 it would be recorded in thebooks of accounts only in February 2010.

2) Accrual basis:

Under this however, revenues and costs are recognized in the period in which they occur rather when they are paid. It means it record the effect of transaction

is taken into book in the when they are earned rather than in the period in which cash is actually received or paid by the enterprise. It is more appropriate basis

for calculation of profits as expenses are matched against revenue earned in the relation thereto. For example, raw materials consumed are matched against the

cost of goods sold for the accounting period.

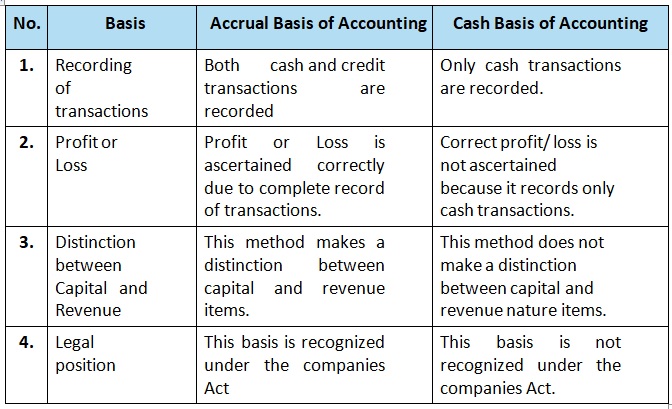

Difference between accrual basis of accounting and cash basis of accounting:

Accounting Standards:

Accounting standards are those written statements, which are issued from time to time by the accounting professionals’ body, specifying uniform rules or practices

for the preparation of the financial statements.

Need for Accounting Standards:

Accounting standards are needed to improve reliability and bring uniformity in accounting practices and to ensure transparency, consistency, and comparability in

financial information.

Benefits of Accounting Standards:

• Accounting standards makes the financial statements more reliable.

• Accounting standards help in resolving conflict of financial interest among various groups.

• Accounting standards ensure the consistency and comparability of financial statements.

• Accounting standards significantly reduce the chances of manipulations and frauds.

Accounting-Standards (AS):

The ICAI has issued the following standards:

• AS 1 Disclosure of Accounting Policies.

• AS 2 Valuation of Inventories.

• AS 3 Cash Flow Statements.

• AS 4 Contingencies and Events Occurring after the Balance Sheet Date.

• AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies.

• AS 6 Depreciation Accounting.

• AS 7 Construction Contracts.

• AS 8 Accounting for Research and Development.

• AS 9 Revenue Recognition.

• AS 10 Accounting for Fixed Assets.

Goods and Service Tax (GST):

Goods and Services Tax is an indirect tax levied on supply of goods and services with consideration in the course of furtherance of business. GST is built

on the principle of One Nation one Tax. It is a comprehensive, multistage, destination-based tax. GST extends to whole India including Jammu & Kashmir.

Features of GST:

• It is a consumption-based tax.

• Burden can be shifted in respect of GST.

• Taxpayers do not receive a direct pinch while paying indirect taxes.

• It is regressive in nature, and it promotes social welfare

• It is levied on commodities and services.

Advantages of GST:

• Ease of doing business.

• Reduce Tax Evasion.

• Tax system becomes more clear, systematic, and foreseeable.

• Decrease in the cost of goods since tax on tax is eliminated in the GST regime.

Important Questions

Multiple Choice Questions-

Q.1 Generally the duration of an Accounting period is of-

(a) 6 months

(b) 3 months

(c) 12 months

(d) 1 month.

Q.2 The sum of Liabilities and Capital is-

(a) Expense

(b) Income

(c) Drawings

(d) Assets.

Q.3 In India, the accounting standard board was set up in the year-

(a) 1972

(b) 1977

(c) 1956

(d) 1932.

Q.4 The basic accounting postulates are denoted by –

(a) Concepts

(b) Book – keeping

(c) Accounting standards

(d) None of these.

Q.5 The amount drawn by businessmen for his personal use is-

(a) Capital

(b) Drawing

(c) Expenditure

(d) Loss.

Q.6 Meaning of credibility of going concern is:

(a) Closing of business

(b) Opening of business

(c) Continuing of business

(d) None of these.

Q.7 Which of the following categories of information is NOT provided by Financial Accounting?

(a) Overheads

(b) Cash Flow

(c) Financial Position

(d) Profit or Surplus

Q.8 The Trading and Profit and Loss Account is prepared under which attribute of accounting:

(a) Summarising

(b) Recording

(c) Classifying

(d) Analysis and Interpretation

Q.9 Identified and measured economic events should be recorded in _________ order.

(a) Chronological

(b) Financial

(c) Proper

(d) Monetary

Q.10 Which of the following statements is correct:

(a) Book Keeping is a part of Accounting.

(b) Accounting is a part of book-keeping.

(c) The term book-keeping and accounting can be used interchangeably.

(d) Book keeping is not a part of accounting.

Answer : Book Keeping is a part of Accounting.

Very Short-

1. How is the total amount of Capital calculated?

2.How is the total amount of Liabilities calculated?

3. Give 2 examples of Capital receipts.

4. Mention different types of liabilities.?

5. What are the drawings?

6. Give 2 examples of Tangible assets.

7. The amount which the proprietor has invested in a business is known as,

8. A Ltd. imported from London one machinery for sale in India and other machinery for production purpose. Will you treat them as goods or fixed assets?

9. What is income?

10. What are the different bases of accounting?

Short Questions-

1. When should revenue be recognised? Are there exceptions to the general rule?

2. What is the basic accounting equation?

Long Questions-

1. Why is it necessary for accountants to assume that business entity will remain a going concern?

2. ‘Only financial transactions are recorded in accounting’. Explain the statement.

3. What is matching concept? Why should a business concern follow this concept? Discuss.

4. Briefly explain your understanding of IFRS and also give the underlying assumptions in IFRS.

Case Study Based Question-

1. Read the following hypothetical text and answer the given questions: -

Olly and Robin are two friends graduated from a top college of the country. After the college, they decide to build a start up in their hometown, Bengaluru.

They decided to start a subscription service of fruits in the nearby cities. For obtaining high-quality fruits, they made 5-year contracts with farmers in and

around Karnataka. They also decided to purchase machinery for cleansing and quality check of the fruits. The business of the company started booming.

Two years down the line, they had built a strong brand and reputation. To leverage the same, the company decided to venture into other states as well with

the similar service line. They first expanded to Tamil Nadu and got great emand. While accounting, company usually booked a normal loss to account forspoiled

fruits that they might get. Moreover, they charged depreciation on the machinery to ensure that expenses are distributed over the years. With all these good practices,

after four more years of operations, the company attained a unicorn status.

Questions:

1. “They first expanded to Tamil Nadu and got great demand.” Which type of GST is applicable on this supply to Tamil Nadu?

(a) Centre GST

(b) State GST

(c) Integrated GST

(d) Both (a) and (b)

2. Which AS will be applicable to evaluate the reputation and brand value of firm?

(a) AS-20

(b) AS-26

(c) AS-30

(d) AS-2

3. The principle highlighted in the line, “Moreover, they charged depreciation on the machinery to ensure that expenses are

distributed over the years” is matching principle.

(a) True

(b) False

(c) Partially false

(d) Can’t say

4. Which concept is highlighted in the fact that company made long-term contracts with the farmers?

(a) Going concern concept

(b) Accrual concept

(c) Consistency concept

(d) Both (a) and (b)

5. Which principle is highlighted in the line, “While accounting, company usually booked a normal loss to account for

spoiled fruits that they might get”?

(a) Business entity principle

(b) Prudence principle

(c) Materiality principle

(d) Full disclosure principle

2. Read the following hypothetical text and answer the given questions: -

GoluPlastic Ltd (GPL) is a leading plastic articles manufacturing company. It was listed on Indian stock market in 1999. The founders and promoters

of the company hold the highest number of shares of the company, approximately around 55%. All these founders belong to a single family. Unfortunately,

all of them died in a car accident recently. However, the company continued to exist and grow.In the year 2004, the company imported multiple machines

for producing low – cost plastic sheets. The machines were recorded at the price prevailing in 2004 and have been subjected to depreciation year on year based

on written down value method. The depreciation is treated as a non-cash expense while preparing the cash flow statement. When GST was implemented in 2017,

it benefitted the company by streaming the processes. A single rate of GST was charged on the supply of the goods and the process of filing was very simple.

Question:

1. Which principle is highlighted in the line, ‘‘The machines were recorded at the price prevailing in 2004”?

(a) Full disclosure principle

(b) Conservatism principle

(c) Duality principle

(d) Historical cost principle

2. “A single rate of GST was charged on the supply of the goods …”. Who levy GST on this common base?

(a) Centre government

(b) State government

(c) Union territory government

(d) Both (a) and (b)

3. Which principle/concept is highlighted in the line,” … and have been subjected to depreciation year on year

based on written down value method.”?

(a) Full disclosure principle

(b) Business entity principle

(c) Consistency concept

(d) Accrual concept

4. Which principle is highlighted in the fact that the company continued even after death of the founders?

(a) Business entity principle

(b) Money measurement principle

(c) Duality principle

(d) Historical cost principle

5. Which AS is required to be followed to prepare cash flow statements?

(a) AS-1

(b) AS-2

(c) AS-3

(d) AS-4

MCQ Answers-

1. Answer: (c) 12 months

2. Answer: (d) Assets.

3. Answer: (b) 1977

4. Answer: (a) Concepts

5. Answer: (b) Drawing

6. Answer: (c) Continuing of business

7. Answer: Overheads

8. Answer: Summarising

9. Answer: Chronological

10. Answer: Book Keeping is a part of Accounting.

Very Short Answers-

1. Ans. Capital = Assets – Liabilities

2. Ans. Liabilities = Assets – Capital

3. Ans.

• The amount received by way of loans

• The amount received from the sale of fixed assets or investments

4. Ans.

• Current liabilities

• Non-current liabilities

• Contingent Liabilities

5. Ans. Drawings refer to any value of commodities or cash withdrawn by the owner for personal use.

6. Ans.

• Stock

• Land and Building

7. Ans. Capital

8. Ans. First machinery will be treated as goods and the second machinery will be treated as Fixed Asset.

9. Ans. Excess of revenue over expenses is called as Income.

10. Ans. Different bases of accounting are,

• Cash basis

• Accrual basis

Short Answers-

1. Ans. Revenue should be recognised when sales take place either in cash or credit and/or right to receive income from any source is

established. Similarly, rent for the month of March even if received in April month will be treated as revenue of the financial year ending 31st March.

There are two exceptions of this rule:

a. In case of sales on installment basis, only the amount collected in installments is treated as revenue.

b. In case of long term construction contracts, proportionate amount of revenue, based on part of the contract completed by the end of the financial year is treated as realised.

2. Ans. The basic accounting equation is given below

Assets = Liabilities + Capital

or

Assets = Claim of Outsiders + Owner’s Equity or Capital.

Long Answers-

1. Ans. Going Concern Concept assumes that the business entity will continue its operation for an indefinite period of time. It is necessary

to assume so, as it helps to bifurcate revenue expenditure (i.e. expenditure related to current year), and capital expenditure (i.e. expenditure

whose benefits accrue over a period of time). For example, a machinery that costs Rs 1,00,000, having an expected life of 10 years, will be treated

as a capital expenditure, as its benefit can be availed for more than one year; whereas, the per year depreciation of the machinery, say Rs 10,000, will

be regarded as a revenue expenditure.

2. Ans. According to this principle, only those transactions and events are recorded in accounting which are capable of being expressed in terms

of money are recorded in the books of accounts, such as the sale of goods or payment of expenses or receipt of income, etc.

An event may be important for the business (such as dispute among the owners or managers, the appointment of a manager, etc.), but it will not

be recorded in the books of accounts simply because it can not be converted or recorded in terms of money. For instance, strike by workers may

adversely affect the business but it cannot be recorded in the books of accounts unless its effect can be measured in terms of money with a fair degree of accuracy.

Another aspect of this principle is that the transactions that can be expressed in terms of money have to be converted in terms of money before being recorded.It

should be remembered that money is the only measurement which enables various things of diverse nature to be added up together and dealt with. The money measurement

assumption is not free from limitations. Due to the changes in price, the value of money does not remain the same over a period of time. The value of rupee today on account

of rising in price is much less than what it was, say ten years back. As the change in the value of money is not reflected in the book of accounts, the accounting data does not

reflect the true and fair view of the affairs of an enterprise. As, such, to make accounting records relevant, simple, understandable and homogeneous, they are expressed in

a common unit of measurement,i.e., money.

3. Ans. This concept is very important for the correct determination of net profit. According to this principle, expenses incurred in an accounting period should be

matched with revenues during that period i.e., when revenue is recognised in a period, then the cost related to that revenue also needs to be recognised in that period to

enable calculation of correct profits of the business.

The matching concept thus, states that all revenues earned during an accounting year, whether received during that year or not and all costs incurred, whether paid

during the year or not should be taken into account while ascertaining profit or loss for that year. When some expense, say insurance premium is paid partly for the

next year also, the part relating to the next year will be shown as an expense only next year and not this year. This means that that part of the insurance premium against

which benefit will be derived or revenue will be earned in future should be shown in the balance sheet as an asset and the rest is treated as an expense during the current year.

For example, If there is unsold stock at the end of accounting period, then its cost needs to be carried over to next year, so that such cost can be recognised or adjusted with the

revenue earned with the sale of such stock.

Similarly, if a machinery is purchased with useful life of 10 years, then its cost needs to be spread over these 10 years, so that it gets adjusted with the revenue earned in those

10 years. If revenue is received for which expenses are to be incurred in next year, then such revenue is also carried over to next year to be matched with its cost only.

A business concern should follow this concept otherwise it will be very much difficult to ascertain the profit or loss of a given period of time.

4. Ans. International Financial Reporting Standards (IFRS):-

Globalisation has unified different economies of the world. Enterprises are carrying on business worldwide. As accounting is the language of business, different

enterprises around the world should not be speaking different languages in their financial statements. It will be very difficult to understand and compare these statements.

International Financial Reporting Standards (IFRS) are issued by the International Accounting Standard Board (IASB). IASB replaced International Accounting.Standard

Committee (LASC) in 2001.LASC was formed in 1973 to develop accounting standards which have global acceptance and makes different accounting statements of different

countries similar and comparable.

Assumptions in IFRS:-

The underlying assumptions in IFRS are as follows:

1) Measuring Unit Assumption:- Current purchasing power is the measuring unit which means that assets in the balance sheet are shown at current or fair value and not at historical cost.

2) Constant Purchasing Power Assumption:- It means that the value of capital is to be adjusted for inflation at the end of the financial year.

3) Accrual Assumption:- Transactions are recorded as and when they occur and the date of settlement is irrelevant.

4) Going Concern Assumption:- It is assumed that the life of the business is infinite.

Case Study Answer-

1. Answer:

1. (c) Integrated GST

2. (b) AS-26

3. (a) True

4. (a) Going concern concept

5. (b) Prudence principle

2. Answer:

1. (d) Historical cost principle

2. (d) Both (a) and (b)

3. (c) Consistency concept

4. (a) Business entity principle

5. (c) AS-3