Important Questions

Multiple Choice Questions-

Q.1 Anil, the Petty Cashier of Ebony, has an imprest of Rs.5,000 out of which he pays for petty

expenses. He submits the details of payments every 15 days which is reimbursed to him. He submitted

the details for 15 days that ended on 15th April, 2012 amounting to Rs. 4,900. He has with him unpaid

expense vouchers amounting to Rs.2,200. How much amount should be paid to him?

a) Rs.4,900

b) Rs.5,000

c) Rs.2,200

d) Rs.7,100

Q.2 It is system of paying advance in the beginning and reimbursing the amount spent from time

to time to the petty cashier.

a) Imprest System

b) Financial System

c) Analytical System

d) Ordinary System

Q.3 The Sales Book is a part of:

a) Journal

b) Trading A/c

c) Balance Sheet

d) Ledger

Q.4 Which account will be debited in case Life insurance premium is paid by proprietor from business

cash?

a) Drawings A/c

b) Capital A/c

c) Insurance A/c

d) Cash A/c

Q.5 While passing an opening entry, all the assets are______while all the liabilities are_____

a) Debited , credited

b) Credited, Credited

c) None of the options

d) Credited, Debited

Q.6 Which account will be debited in case wages are paid for installation of machinery?

a) Machinery A/c

b) Installation A/c

c) Wages A/c

d) Cash A/c

Q.7 What are total number of subsidiary books available to record financial transactions?

a) 8

b) 7

c) 6

d) 12

Q.8 Name the transaction that is recorded in both sides of Cash book simultaneously.

a) Contra Entry

b) Dual entry

c) Double entry

d) Single entry

Q.9 All the indirect expenses are closed to_____

a) Profit and loss A/c

b) Cash Flow Statement

c) Balance sheet

d) Trading A/c

Q.10 The Sales Return Book always has______balance

a) Debit

b) Either debit or credit

c) Credit

d) None of the options

Very Short-

1. Define compound voucher.

2.Define a journal voucher.

3. Define a complex transaction.

4. Give three elements of accounting voucher.

5.What does accounting equation signify?.

6. What are the two rule to follow when changing record in assets/expenses (Losses)?.

7. If total assets of a business are Rs 2,60,000 and capital is Rs 1,60,000 calculate the outside liabilities.

8. If total assets of a business are Rs 2,60,000 and net worth is Rs 1,60,000. Calculate the creditors.

9. Do you think that a transaction can break the accounting equation?

10. State when is a capital account debited.

Short Questions-

1. When proprietor withdraws cash for his/her personal use what will be the effect on capital?

2. When an account is said to have a debit balance and credit balance?

3. Why is the evidence provided by source documents important to accounting?

4. What is the two rule to follow when changing record in liabilities and capital change/Revenue(Losses)?

5. State journal entries that are subdivided into a number of books of original entry

6. Give two differences between journal and ledger.

Long Questions-

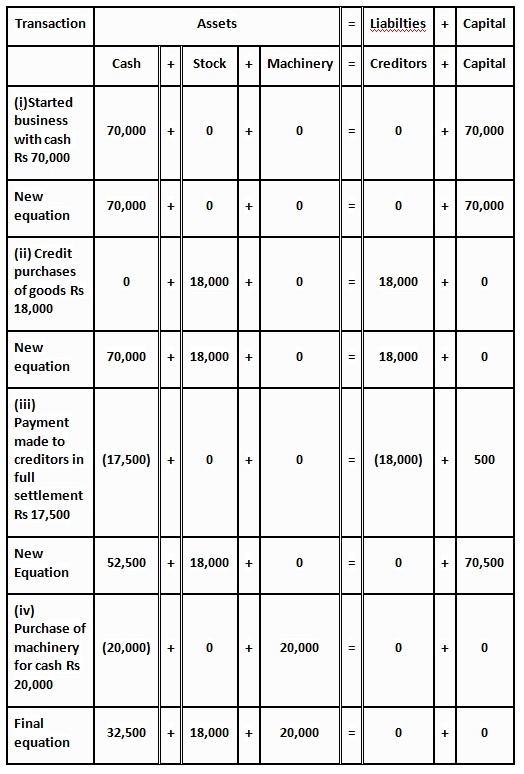

1. Prepare the accounting equation on the basis of the following

i. Started business with cash Rs 70,000.

ii. Credit purchases of goods Rs 18,000.

iii. Payment made to creditors in full settlement Rs 17,500.

iv. Purchase of machinery for cash Rs 20,000.

2. What entry (debit or credit) would you make to

i. increase revenue,

ii. decrease in expense

iii. record drawings,

iv. record the fresh capital introduced by the owner.

3. ‘Analyse the effect of each transaction and prove that the accounting equation(A = L + C) always remains balanced.

i. Introduced Rs 4,00,000 as cash and Rs 25,000 by stock.

ii. Purchased plant for Rs 1,50,000 by paying Rs 7,500 in cash and balance at a later date.

iii. Deposited Rs 3,00,000 into the bank.

iv. Purchased office furniture for Rs 50,000 and made payment by cheque.

v. Purchased goods worth Rs 40,000 for cash and for Rs 17,500 on credit.

vi. Goods amounting to Rs 22,500 was sold for Rs 30,000 on cash basis.

vii. Goods costing to 1 40,000 was sold for 1 62,500 on credit basis.

viii. Cheque issued to the supplier of goods worth Rs 17,500.

ix. Cheque received from customer amounting to Rs 37,500.

x. Withdrawn by owner for personal use Rs 12,500.

Case Study Based Question-

1. Read the following hypothetical text and answer the given questions: -

Joe and Jimmy started a bat manufacturing company. They set up a factory in Meerut (UP) on a land purchased

for ₹ 40,00,000. They purchased raw material from a trader in Jalandhar (Punjab) for ₹ 5,00,000 at credit. However,

they did not like the quality of some of the goods that were sent and therefore decided to return the same. The company

were producing premium bats. Even some of the domestic players of Indian cricket team purchased bats from the company

and endorsed the same as well. This led to mass orders rolling in frequently. After a year, they also started to get bulk orders

from academies, institutes and corporates. On one instance, they were given an order by NPS Public School, one of the largest

school chains in the country for bat worth ₹2,50,000. The company took a week to fulfil and received half the payment while the

other half was due for 6 months later. The company successfully delivered the bats to the head office of NPS Public School in Delhi.

Question:

1. As a result of transaction of ordering raw material, the liabilities of company increased.

(a) True

(b) False

(c) Partially true

(d) Can’t say

2. The company must have received ……… from the seller of raw materials as a source document.

(a) cash memo

(b) invoice

(c) credit note

(d) receipt

3. What is issued by the company along with the goods returned?

(a) Credit note

(b) Debit note

(c) Bill

(d) Receipt

4. What was the accounting equation for the transaction of land purchased? (The options are in the format of Assets = Liabilities + Capital)

(a) 40,00,000 = 0 + 40,00,000

(b) 40,00,000 + (40,00,000) = 0 + 0

(c) 0 = 40,00,000 + (40,00,000)

(d) 40,00,000 = 40,00,000 + 0

5. As a result of transaction with NPS school, the company’s net assets ………, liabilities ……… and capital ………. (ignore profit/loss).

(a) decreased, decreased, unchanged

(b) increased, increased, unchanged

(c) unchanged, unchanged, unchanged

(d) increased, unchanged, unchanged

2. Read the following hypothetical text and answer the given questions: -

KLR Ltd. is publicly listed company trading in EV batteries. The company is known to have an advanced version

of EV battery which can be used in almost all types of EV cars. As a result of onset of EV trend in India, company is

getting lot of pre-orders. Recently, one of the largest cab aggregators of India collaborated with the company to get

batteries. Against this order, company received an advance of ₹ 10,00,000. When the EV batteries were delivered, company

received the rest of the payment of ₹ 5,00,000. The company sent a source document for these goods sold. Consequently, the

company deposited the money received in the bank account. To produce and fulfil the further orders, the company decided to

purchase a new 3D modular. It was worth ₹ 1,00,000 and company issued a document in writing drawn upon a specified banker

and payable on demand. The company also employed an experienced manager to streamline the operations. As a result, company

continued to prosper and its stock prices also shot up.

Question:

1. Which document is highlighted in the line, “The company sent a source document for these goods sold”?

(a) Debit note

(b) Credit note

(c) Cash memo

(d) Bill

2. What is the accounting equation for advance received against order? [Use format Asset = Liabilities + Capital]

(a) 15,00,000 + (15,00,000) = 0 + 0

(b) 10,00,000 + (10,00,000) = 0 + 0

(c) 10,00,000 = 10,00,000 + 0

(d) None of the above

3. Which document must be used to deposit money in the bank?

(a) Cheque

(b) Pay-in-slip

(c) Bill

(d) Receipt

4. Which of following would be unchanged as a result of transaction of purchasing 3D moulder of ` 1,00,000?

(a) Capital

(b) Assets

(c) Liabilities

(d) All of these

5. Which document is highlighted in the line, “It was worth `1,00,000 and company issued a document in writing drawn upon a specified banker and payable on demand”?

(a) Cheque

(b) Pay-in-slip

(c) Credit note

(d) Debit note

MCQ Answers-

1. Answer: Rs.4,900

2. Answer : Imprest System

3. Answer: Journal

4. Answer: Drawings A/c

5. Answer: Debited , credited

6. Answer: Machinery A/c

7. Answer: 8

8. Answer: Contra Entry

9. Answer: Profit and loss A/c

10. Answer: Debit

Very Short Answers-

1. Ans. Compound vouchers are those vouchers which record different single or multiple debit/credit transactions.

2. AnsJournal voucher is a document that contains essential information pertaining to a accounting transaction.l

3. Ans. Transactions that consist of a series of events leading to its completion is called complex transaction.

4. Ans.he three elements of accounting voucher are.

• Name of the company should be printed on the top

• The voucher number should be mentioned in the serial order

• Debit and credit amount should be written in figures against the amount

5. Ans. Accounting equation implies that the assets of a company are regularly equivalent to the total of its liabilities

and capital (owner’s equity).

6. Ans.The two rules to follow while recording differences in Assets/Expenses (Losses) are.

• A rise in an asset is debited, and the drop in the asset is credited.

• A Rise in expenses/losses is debited, and the drop in expenses/ losses is credited.

7. Ans: Total Assets = Capital + Outside Liabilities

• 2,60,000 = 1,60,000 + Outside Liabilities

• 2,60,000 – 1,60,000 = Outside Liabilities

• Outside Liabilities = 1,00,000

8. Ans. Total Assets = Net worth – Creditors

• Creditors = Total Assets – Net worth

• Creditors = 2,60,000 – 1,60,000

• Creditors = Rs. 1,00,000

9. Ans. No, any transaction can only change the equation but can’t break it. The Accounting equation remains equal..

10. Ans. A capital account is debited when there is a loss and when the owner makes drawings.

Short Answers-

1. Ans. Decrease in capital. A drawing account is an accounting record maintained to track money withdrawn

from a business by its owners.

2. Ans. The difference between the sum of the two sides of an account is called thebalance. This is the most important

part of an account as it shows value or position ofasset, liability, capital, income or expenses of which the account is a

record. If the total of the debit side exceeds the total of credit side then this would be represented by a debit balance and

opposite is true for a credit balance.

3. Ans. A source document is the original document that contains the details of a business transaction. A source document

captures the key information about a transaction, such as the names of the parties involved, amounts paid (if any), the date,

and the substance of the transaction. Source documents are frequently identified with a unique number, so that they can be

differentiated in the accounting system. The pre-numbering of documents is particularly useful, since it allows a company to

investigate whether any documents are missing. Source documents are critical to auditors, who use them as evidence that recorded

transactions actually occurred. A source document is also used by companies as proof when dealing with their business partners,

usually in regard to a payments.

4. The two rules to follow when changing record in liabilities and capital change/Revenue(Losses) are.

• A rise in the liabilities is credited and the drop in liabilities is debited.

• A rise in the capital is credited and the drop in the capital is debited.

5. Ans. The journal is subdivided into a number of books of original entry are.

• Journal Proper

• Cashbook

• Other books:

Purchases (journal) book

Sales (journal) book

Purchase Returns (journal) book

Sale Returns (journal) book

Bills Receivable (journal) book

Bills Payable (journal) book

6. The two differences between journal and ledger are.

• For a transaction, journal is the intial book of entry. And the ledger is a second book of entry.

• The recording process in the journal is known as journalising. The recording process in the ledger is known as posting..

Long Answers-

1. The fundamental accounting equation, also called the balance sheet equation, represents the relationship

between the assets, liabilities, and owner’s equity of a person or business. It is the foundation for the double-entry

book keeping system. For each transaction, the total debits equal the total credits.

Accounting equation

2. The following entry will be made in the above case

i. Increase Revenue-Revenue account have always credit balance so credit entry will be made to record increase in revenue.

ii. Decrease in Expense- Expense account always have a debit balance so credit entry will be made to record decrease in expenses.

iii. Record Drawings- Drawings is a reduction of capital balance so debit entry will be made in capital account to record drawings.

iv. Record the fresh Capital Introduced by the Owner- Capital account always have a credit balance so credit entry will be made to

record increase in capital.

Case Study Answer-

1. Answer:

1. (a) True

2. (b) invoice

3. (b) Debit note

4. (b) 40,00,000 + (40,00,000) = 0 + 0

5. (c) unchanged, unchanged, unchanged

2. Answer:

1. (c) Cash memo

2. (c) 10,00,000 = 10,00,000 + 0

3. (b) Pay-in-slip

4. (d) All of these

5. (a) Cheque