Important Questions

Multiple Choice Questions-

Q.1 Which of the following is not a business transaction?

(a) Bought furniture of Rs. 10,000 for business

(b) Paid for salaries of employees Rs. 5,000

(c) Paid sons fees from her personal bank account Rs. 20,000

(d) Paid sons fees from the business Rs. 2,000

Q.2 Deepti wants to buy a building for her business today. Which of the following is the relevant data for his decision?

(a) Similar business acquired the required building in 2000 for Rs. 10,00,000

(b) Building cost details of 2003

(c) Building cost details of 1998

(d) Similar building cost in August, 2005 Rs. 25,00,000

Q.3 Which is the last step of accounting as a process of information?

(a) Recording of data in the books of accounts

(b) Preparation of summaries in the form of financial statements

(c) Communication of information

(d) Analysis and interpretation of information

Q.4 Which qualitative characteristics of accounting information is reflected when accounting information is clearly presented?

(a) Understandability

(b) Relevance

(c) Comparability

(d) Reliability

Q.5 Use of common unit of measurement and common format of reporting promotes.

(a) Comparability

(b) Understandability

(c) Relevance

(d) Reliability

Very Short Questions –

Q.1 Mention 3 functions of Accounting.

Q.2 Define Book-keeping.

Q.3 Who are the users of Accounting?

Q.4 Mention the types of accounting.

Q.5 What is the traditional function of accounting?

Q.6 Mention 2 qualitative characteristics of accounting information.

Q.7 What is the end product of financial accounting?

Short Questions –

Q.1 Define Accounting.

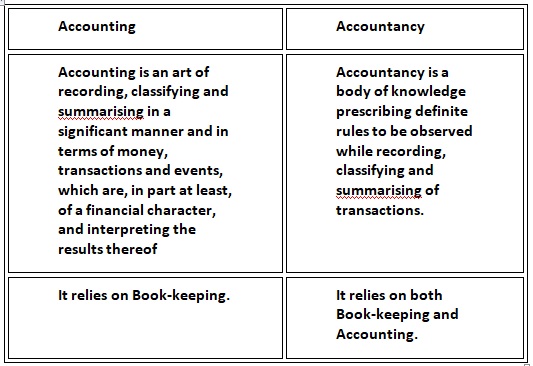

Q.2 Mention 2 Differences between accounting and accountancy.

Q.3 What are the 3 advantages of accounting?

Q.4 What are the 5 roles of accounting?

Q.5 Confidence and trust that the reported information is a reasonable representation of the actual items and

events, that have occurred, indicate which qualitative characteristic of accounting information.

Q.6 State whether a large order of supply of goods received by the firm be recorded in books.

Q.7 Appointment of a new managing director is not recorded in the books of accounts. Why?

Q.8 What is a person to whom money is owed by a firm called?

Long Questions –

Q.1 Is accounting an art or a science?

Q.2 Accounting information refers to financial statements. The information provided by these statements can be

categorised into various types. Briefly describe them.

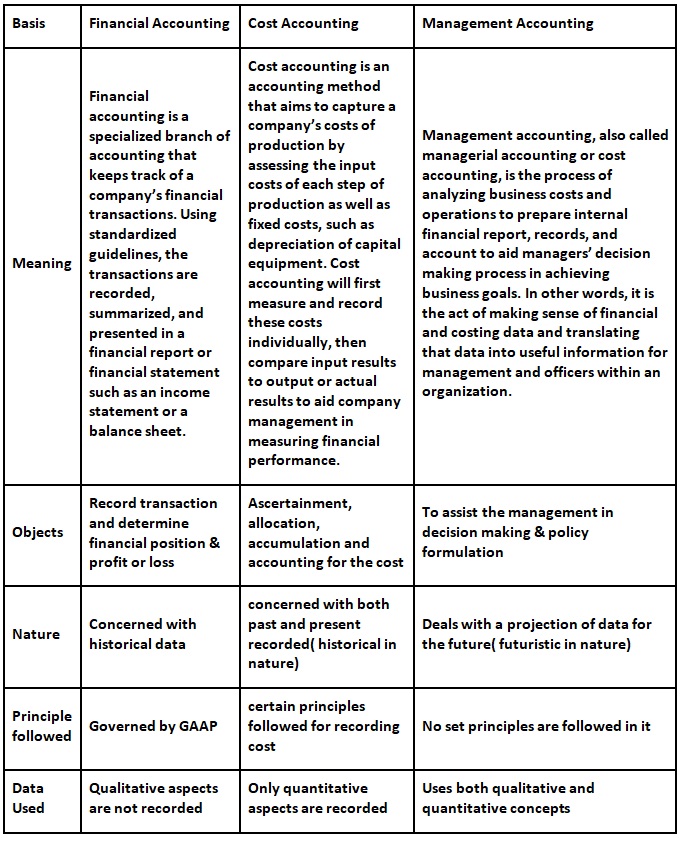

Q.3 Distinguish between financial accounting, cost accounting, and management accounting.

Q.4 Distinguish between book-keeping, accounting, and accountancy..

Q.5 Basic objective of accounting is to provide useful information to various users. Besides these, there are many

other objectives of accounting. Explain any four of them.

Case Study Based Question-

1. Read the following hypothetical text and answer the given questions: -

Sen and Shetty are two friends who both have just attended their first class of accountancy.Thefriends were intrigued by the

different branches of accounting and their widespread application. Sen personally liked the branch of accounting in which fund

flow statement and budgetary control is used and that branch helps in planning and controlling of operations.Asthe concept of

accounting was further explored, they began discussing the different users of accounting. Sen said that he finds it interesting that

even the employees demand information relating to business. Shetty said he finds more interesting the fact that even competitors

want information on the relative strengths and weaknesses of the enterprise and for making comparisons. Shetty further said that

even accounting helps owners to compare one year’s costs, expenses, and sales with those of other years. However, they were quite

shocked by the fact that the management-worker relations was not taken into consideration in the accounting.Meanwhile, Sen and

Shetty had an argument at the end of the discussion. Sen was saying that accounting is an art whereas Shetty was saying that accounting

is a science. Their teacher came in and said something to them which made them stop the argument.

Questions:

1. What might have their teacher said to solve their argument?

(a) Sen, please understand, Shetty is correct in this situation

(b) Shetty, please understand, Sen is correct in this situation

(c) Both are correct

(d) None is correct

2. Shetty talked about which type of users of accounting?

(a) Internal users

(b) External users

(c) Both (a) and (b)

(d) None of these

3. Which limitation of accounting is being talked by them?

(a) Influenced by personal judgement

(b) Omission of qualitative information

(c) Incomplete information

(d) Based on historical costs

4. Which advantage of accounting is being talked by Shetty in last part of first para?

(a) Provides information regarding profit and loss

(b) Provides completes and systematic record

(c) Enables comparative study

(d) Evidence in legal matters

5. Which branch of accounting is liked by Sen?

(a) Financial accounting

(b) Cost accounting

(c) Management accounting

(d) Tax accounting

2. Read the following hypothetical text and answer the given questions: -

Ben and Jones started with Cash ₹ 10,000 and Machinery ₹ 1,00,000. They decided to set up a production line for PPE kits for the protection from Covid 19 virus. As their demand expanded, they decided to purchase one more machinery. For the same, they took bank overdraft and purchased the machinery. The quality of the company’s product was very high and therefore, it could develop a reputation for itself in the market and business was flourishing. After 1.5 years, their old machinery turned obsoleteso they decided to sell the same.They sold it and got some cash proceeds. To further increase the brand presence among the concerned stakeholders, they decided to run advertisements from the cash proceeds of machinery sold. As more and more customers demanded their product, they decided to launch a discount for bulk purchases. The discount was not to be recorded in the books of accounts. This campaign was successful and they earned lot of profits from the same.

Questions:

1. Which type of discount is being discussed in the last part of passage?

(a) Trade discount

(b) Cash discount

(c) Both (a) and (b)

(d) Can’t be determine

2. Which asset is discussed in the line, “The quality of the company’s product was very

high and therefore, it could develop a reputation for itself in the market and business was flourishing”?

(a) Tangible

(b) Intangible

(c) Current

(d) Both (a) and (c)

3. Which type of liability is discussed in the passage?

(a) Non-current

(b) Current

(c) Both (a) and (b)

(d) Can’t be determined

4. What was the capital initially invested?

(a) ₹ 10,000

(b) ₹ 1,00,000

(c) ₹ 1,10,000

(d) Can’t be determined

5. The passage involves capital receipts (apart from initial capital invested).

(a) True

(b) False

(c) Partially true

(d) Can’t say

MCQ Answers –

1. Answer: (c) Paid sons fees from her personal bank account Rs. 20,000

2. Answer: (a) Similar business acquired the required building in 2000 for Rs. 10,00,000

3. Answer: (c) Communication of information

4. Answer: (a) Understandability

5. Answer: (a) Comparability

Very Short Answers –

1. Answer: Functions of accounting are:

• Communicating financial information

• Budget preparation

• Preventing errors and frauds

2. Answer: According to J.R. Batliboi, ‘Book-keeping is an art of recording business dealing in a set of books.’

3. Answer: The users may be categorised into 2 groups. Namely,

• Internal users

• External users

4. Answer: There are 5 types of accounting. Namely,

• Financial Accounting

• Cost Accounting

• Management Accounting

• Tax Accounting

• Social responsibility Accounting

5. Answer: Recording of financial transactions.

6. Answer:

• Reliability

• Comparability

7. Answer:End product of financial accounting is ‘Financial Statements’.

Short Answers –

1. Answer:According to the American Institute of Certified Public Accountants, Accounting is, ‘It is an art of

recording, classifying and summarising in a significant manner and in terms of money, transactions and

events, which are, in part at least, of a financial character, and interpreting the results thereof.’

2.

3. Advantages of accounting are,

• Helpful in business

• Helpful in decision making

• Helpful in controlling

4. Roles of accounting are:

• Acting as the language of business

• Providing financial information to stakeholders

• Role in creation of budget

• Role in decision making

• Role in determining profit and loss

5. It indicates the qualitative characteristics of reliability.

6. No, it is not a transaction.

7. it cannot be recorded because it is impossible to measure it in monetary terms.

8. The person to whom the firm owes money is called ‘Creditor’.

Long Answers –

1.Answer:

Accounting is both an art as well as a science. It can be seen in the following points :

• Accounting as an Art : As an art it is the technique of achieving some pre-determined objectives. Accounting

is an art of recording, classifying and summarising financial transactions of the business. It helps us in ascertaining

the net profit and financial position of the business enterprise.

• Accounting as Science: Science is an organised body of knowledge based on certain basic principles. Therefore, accounting

is also a science as it is an organised body of knowledge based on certain accounting principles.

2.Answer:

Types of Accounting Information

Accounting information refers to the information provided in financial statements of the business, generated

through the process of book keeping and summarising. By using the accounting information, the users are in a

position to take the correct decision. The financial statements so generated are the income statement i.e., profit

and loss account and the position statement i.e., balance sheet and a Cash Flow Statement. The information made

available by these statements can be categorised into the following categories:

1) Information Related to Profit or Loss during the year: Information about the profit earned or loss incurred by the

business during an accounting period is made available through the income statement of the business i.e., the profit

and loss account. Trading account provides information about gross profit or gross loss whereas the profit and loss

account provides information about the net profit or net loss during the year. It also gives details of all the expenses

and incomes during the year.

2) Information Related to Financial Position of the business :Information about the financial position of the enterprise

is determined through its position statement i.e., the balance sheet. It provides information about the assets and liabilities

of a business on a particular date. The difference between the two is represented by capital i.e., amount due to owners. In the

case of not-for-profit organisation, difference between assets and liabilities is termed as general fund.

3) Information about Cash Flow during the year : Cash flow statement is a statement that shows inflow and outflow of cash |

during a specific period. It helps in making various decisions such as payment of liabilities, payment of dividend and expansion

of business, etc., as all these are based on availability of cash. It gives a clear picture of the liquidity of the business.

3.Answer:

4.Answer:

Bookkeeping is the activity of recording the financial transactions of the company in a systematic manner while Accounting

is an orderly recording and reporting of the financial affairs of an organization for a particular period while accountancy is

to summarize, classify and accordance of every financial activity into a system. Book-keeping is a primary and basic function

in the process of accounting and concerned with recording and maintenance of books of accounts only. Accounting is the secondary

function and it starts where function of book-keeping ends. Accountancy is a study of systematic knowledge and contains those rules,

regulations, procedures, principles, concepts, conventions and techniques, which are to be applied in the process of accounting. In this

sense, we can say that accountancy is a broader term that acts as a guide for the preparation of books of accounts, summarisation of

information and communicating the results to all the concerned parties.

5.Answer:

The objectives of accounting are as follows:-

Identification and recording of the transactions of the business: Accounting enables business firms to maintain systematic records of

all financial transactions. Various properties and possessions, as well as obligations, are also recorded. As a result, the true nature of

each and every transaction is known without much exercise of memory. With this end in view, the transactions are primarily recorded

in general and in a special journal and later on permanently various accounts are kept in the ledger. So that there is no unauthorised

use or disposal of property of business.

Calculation of Profit or Loss: A businessman would be interested in knowing at periodical intervals the net result of business operations, i.e.

how much profit has been earned or how much loss has been incurred. The amount of profit or loss for a particular period of a business concern

can be ascertained by preparing income statement with the help of ledger account balances of revenue nature. Surplus or deficit of revenue for a

particular period of a non-trading concern can also be ascertained by preparing income and expenditure account or statement.

Depiction of position: A proper record is maintained of all assets and liabilities to show the value of the firm’s possessions and the amount the firm

is owing to others at the end of the particular period. With the help of this systematic record, the accountant prepares the balance sheet of the firm

which provides information about the financial position.

Comparison of results: Systematic maintenance of business records enables the accountant to compare profit of one year with those of earlier years

to know the significant facts about the changes. This helps the business to plan its future affairs accordingly.

Case Study Answer-

1. Answer:

1. (c) Both are correct

2. (c) Both (a) and (b)

3. (b) Omission of qualitative information

4. (c) Enables comparative study

5. (c) Management accounting

2. Answer:

1. (a) Trade discount

2. (b) Intangible

3. (b) Current

4. (c) ₹ 1,10,000

5. (a) True