Accounts From Incomplete Records

Meaning of Incomplete Records:

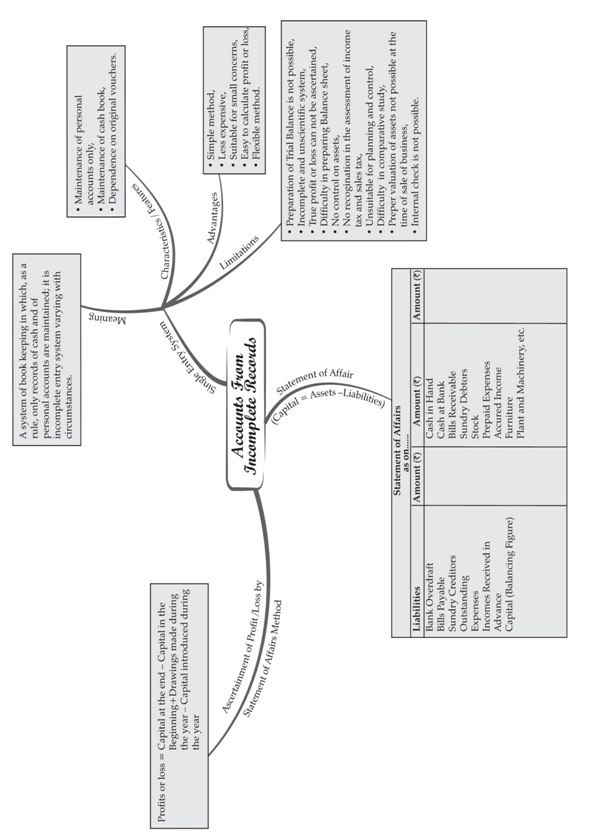

Incomplete records are the accounting records that do not strictly follow the double entry system

of accounting. For example: If one sided entry, or no entry for a transaction is recorded, it is classified

as an incomplete record.

♦ Uses or Reasons for Keeping Incomplete Records:

Simple Method: It is an easy and simple method as under this method one does not require

any special knowledge of the accounting principles for recording of transactions.

Less Expensive: As under this method only few accounts are prepared, therefore business firm

does not require more staff for recording the transactions.

Flexible Method: This method is highly flexible because it can be adjusted according to the needs

of the organisation.

Suitable for Small Concerns: This method is most suitable for small business concerns which have

mostly cash transactions and very few Assets & Liabilities.

Easy to calculate profit or loss: It is easier to calculate profit or loss under this method.

♦ Limitations of incomplete records

Following are the limitations of incomplete records:

Lack of proper maintenance of records: It is an unscientific and unsystematic way of maintaining

records. Real and nominal accounts are not maintained properly.

Difficulty in preparing trial balance: As accounts are not maintained for all items, the accounting

records are incomplete. Hence, it is difficult to prepare trial balance to check the arithmetical accuracy of

the accounts.

Difficulty in ascertaining true profitability of the business: Profit is found out based on available

information and estimates. Hence, it is difficult to ascertain true profit as the trading and profit and loss

account cannot be prepared with accuracy.

Difficulty in ascertaining financial position: In general, only the estimated values of assets and liabilities

are available from incomplete records. Hence, it is difficult to ascertain true and fair view of state of affairs or

financial position as on a particular date.

Errors and frauds cannot be detected easily: As only partial records are available; it may not be possible

to have internal checks in maintaining accounts to detect errors and frauds.

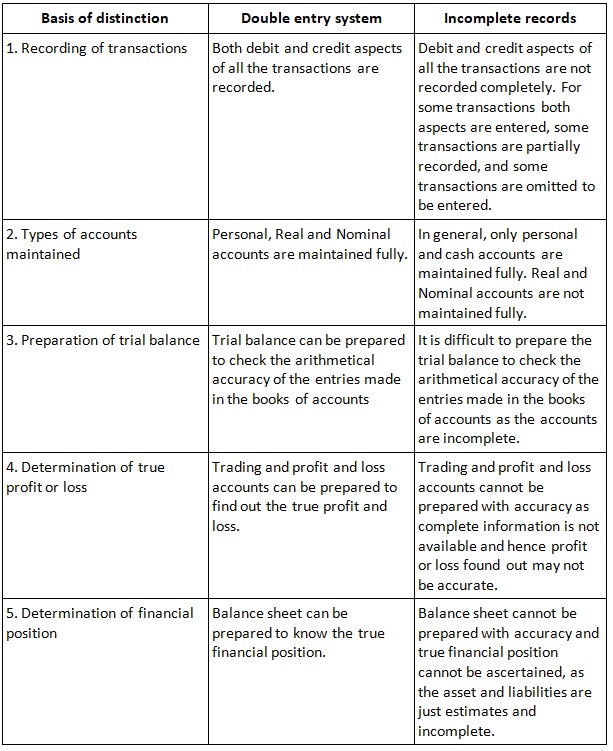

♦ Differences between double entry system and incomplete records:

♦ Ascertainment of Profit or Loss:

The main objective of any business enterprise is to earn profits In case of organizations maintaining accounts

under incomplete records the amount of profit or loss can be ascertained by Statement of Affairs method or Net

Worth method

♦ Statement of Affairs Method:

Under this method, profits or losses of the business are ascertained by comparing the Capital at the end, Capital

at the beginning of the accounting period.

♦ Statement of Affairs:

A Statement of affairs is a statement showing the balances of assets (including cash and bank balance)

on the right-hand side and the balance of liabilities on the left- hand side, on a particulars date. The

difference in the total of two sides is known as capital.

Capital = Total Assets – Total liabilities

A statement of affairs is very similar to Balance Sheet as prepared for the business entities maintaining accounts

under double entry system, though it should not be described as a Balance Sheet.

Multiple Choice Questions-

Q1. A system of accounting which is not based on double entry system is called-

(a) Cash system

(b) Mahajani system of accounting

(c) Incomplete accounting system

(d) None of these

Q2. Accounts which are maintained under single entry system-

(a) Personal accounts

(b) Impersonal accounts

(c) (a) & (b) both

(d) None of these

Q3. Statement of affairs is prepared to-

(a) Know about assets

(b) Know about liabilities

(c) Calculate capital

(d) Know financial position

Q4. Incomplete records are generally maintained by

(a) A company

(b) Government

(c) Small sized sole trader business

(d) Multinational enterprises

Q5. Generally incomplete records are maintained by-

(a) Trader

(b) Society

(c) Company

(d) Government

Q6. Incomplete record mechanism of book keeping is

(a) Scientific

(b) Unscientific

(c) Unsystematic

(d) Both (b) and (c)

Q7. Opening capital is ascertained by preparing

(a) Total debtor’s account

(b) Total creditor’s account

(c) Cash account

(d) Opening statement of affairs

Q8. Credit purchase, during the year is ascertained by preparing :

(a) Total creditor’s account

(b) Total debtor’s account

(c) Cash account

(d) Opening statement of affairs

Q9. Statement of affairs is a

(a) Statement of income and expenditure

(b) Statement of assets and liabilities

(c) Summary of cash transactions

(d) Summary of credit transactions

Q10. Profit can be ascertained from the incomplete records under single entry by using.

(a) Only Statement of Affairs Method

(b) Only Conversion Method

(c) Either (a) or (b) above

(d) None of (a) or (b)

Very Short-

1. What do you mean by Incomplete Record?

2. Give two features of Incomplete Record?

3. Give two reasons for keeping Incomplete Record?

4. Give two limitations of keeping Incomplete Record?

5. State two account maintained in an account from incomplete records.

6. What is the common objective of single entry system and the double-entry system?

7. Which two methods are used in determining profit and loss in a single entry system?

8. Can a limited company maintain its account under single entry system?

Short Questions-

1. Can a limited company maintain its accounts under single entry system?

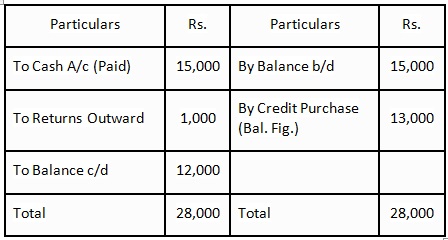

2. Calculate Purchases-

3. In the single entry system, state any method which is used to ascertain profit or loss.

4. Explain how opening capital and closing capital be ascertained from incomplete records?

Long Questions-

1. Following information is given of an accounting year-

Opening Creditors Rs.15,000; Cash paid to creditors Rs.15,000; Returns Outward

Rs.1,000 and Closing creditors Rs.12,000.

Calculate Credit Purchases during the year.

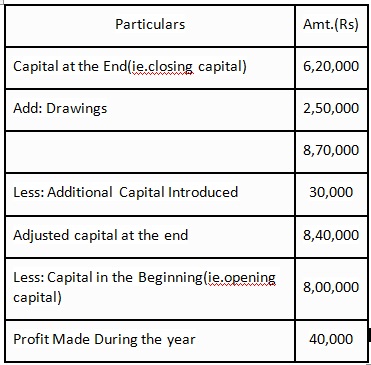

2. Rishant keeps incomplete records of his business. He gives you the following information.

Capital at the beginning of the year Rs 8,00,000; capital at the end of the year Rs 6,20,000, Rs

2,50,000 was withdrawn by him for his personal use; as Rishant needed money for expansion of

his business, he asked his wife for help, his wife allowed him to sell her ornaments and invest that

amount into the business which come to Rs 30,000. Calculate his profit or loss for the year ended.

3. What is meant by single entry system of accounts and give any three salient features.

Answer key

MCQ Answers-

1. Answer: (c) Incomplete accounting system

2. Answer: (a) Personal accounts

3. Answer: (c) Calculate capital

4. Answer: (c) Small sized sole trader business

5. Answer: (a) Trader

6. Answer: (b) Unscientific

7. Answer: (d) Opening statement of affairs

8. Answer: (a) Total creditor’s account

9. Answer: (c) Summary of cash transactions

10. Answer: (c) Either (a) or (b) above

Very Short Answers-

1. Incomplete record refers to those records which are not arranged according to the principles

of double-entry.

2. Ans. he two features of incomplete record are.

• Lack of uniformity in the records.

• It is a mixed system of recording transactions of the business.

3. The two reasons for keeping incomplete record are.

• Convenient Method- It is an easy and uncomplicated method of registering the company’s

transactions as it does not demand any individual knowledge of the principles of double-entry

• Limited resources required – Since only cash book and few ledger accounts are recorded in this

system, the staff required for support is also smaller as compared to the double-entry system.

4. Ans.The two limitations of keeping incomplete record are.

• Trial Balance preparation is not possible- This system does not record both the debit and credit

aspect of a transaction. Due to which the trial balance cannot be prepared, and the accuracy of the

financial transaction cannot be rectified.

• Incomplete system- It is incomplete because of the fact that this system does not record both the

aspect of a transaction (credit & debit). Also, this system does not follow any set of rules.

5. Ans. The two account maintained in an account from incomplete records are.

• Cash account

• Personal Account

6. Ans.The common objective of single entry system and double entry system is to determine the net

profit or loss of the company.

7. Ans. The two methods are used in determining profit and loss in a single entry system are.

• Statement of Affairs Method

• Conversation Method

8. Answer: No, a limited company maintain its account under single entry system.

Short Answers-

1. Answer: No, a limited company cannot maintain its books of accounts under single entry system

due to legal restrictions.

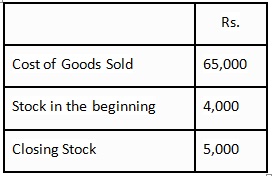

2. Answer: Cost of goods Sold = Purchase + Opening Stock – Closing Stock

65,000 = Purchase + 4,000 – 5,000 n Purchase = Rs.66,000

3. Ans. Statement of Affairs Method or Net Worth Method is generally used to ascertain Profit /Loss

in case of Single Entry System.

4. Answer: Opening capital can be obtained by preparing the statement of affairs at the beginning of the

financial year and the closing capital can be ascertained with the help of the statement of affairs at the

end of the financial year of the firm.

Long Answers-

1. Answer: The term “Sundry” usually refers Small or infrequent customers/companies that are not

assigned individual ledger accounts but are classified as a group. Sundry creditors are such small entities

that the company owes money to. In this question the account is to be maintained as follows:-

Sundry Creditors A/c

2. Answer: Statement of Profit And Loss

for the year ended….

Profit=Closing capital+Drawings-Additionalcapital-Opening capital

3. Meaning of Single Entry System: A single entry system records a transaction with a single entry

and only maintains one side of every transaction. It is the oldest method of recording financial transactions

and is less popular than the double-entry system and is mainly used for entries recorded in the income

statement. This term is used to describe the problems associated with the accounts from an incomplete

transaction and is popularly called as ‘Preparation of accounts from incomplete records’Three Salient features

of Single Entry System :

• Under this method, only one Cash Book is maintained which mixes up both the private and business transaction.

• Under this system, Profit or Loss can be ascertained but not the financial position as a whole.

• Arithmetical accuracy of the account is not possible since Trial Balance can’t be prepared.

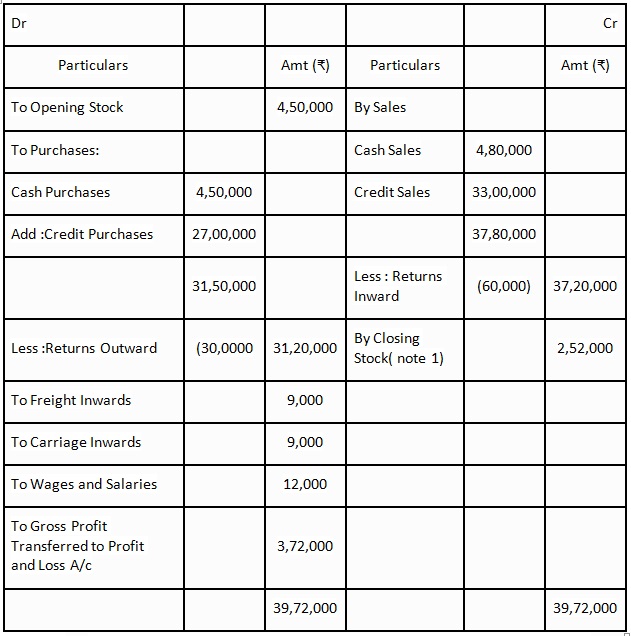

2. Answers

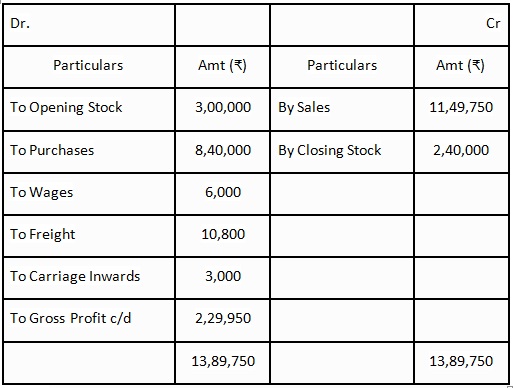

Trading Account

for the year ended 31st March, 2013

i. Closing Stock will be shown in the books at market price or book value price, whichever is less.

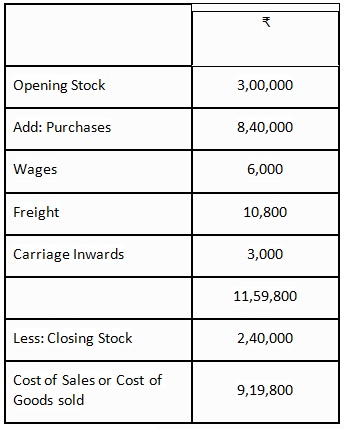

3. Answer: Working Notes :i. Calculation of Cost of goods sold:

ii. Calculation of Sales :

Let us assume that sales = ₹100,

then, gross profit would be = ₹20 (20% of sales)

Therefore, cost of sales would be = Sales – Gross Profit = 100 – 20 = ₹80.

When cost of sales is ₹80, then sales would be = ₹100.

When cost of sales is ₹1, then sales would be =100/80.

When cost of sales is ₹9,19,800, then sales would be =100/80×9,19,800=₹11,49,750.

Trading Account

for the year ended 31st March, 2013