Financial Statements – I

Meaning of Financial Statements:

Financial Statements are the final statements that provide the summary of the accounts of a

business enterprise stating its financial position and financial performance at the end of an

accounting year.

♦ Financial Statements include following statements:

i. Trading and Profit and Loss Account (or Income Statement) that depicts the financial performance

of an enterprise.

ii. Balance Sheet that presents the financial position of the enterprise at the end of an accounting year.

iii. Notes to accounts or Schedules and notes forming part of Balance sheet and Income statement to give

details of various items shown in both the statements.

♦ Objectives of Financial Statement:

Stakeholders of a company heavily rely on financial statements to understand its functioning. They

portray the true state of affairs of the company. Here are some objectives of financial statements:

i. To present the true and fair picture of the financial position of the business.

ii. To reflect the true and fair picture of the financial performance of the business.

iii. To provide detailed information regarding the resources of the company.

iv. To help in the decision making to the owner of the organization.

♦ Importance of Financial Statement:

The significance of financial statements prevails in their service to persuade the diverse interests of

distinct classes of parties such as creditors, public, management, etc.,

♦ Importance to Management: Increase in size and intricacies of aspects influencing the business

functions requires scientific and strategic access in the management of contemporary trading concerns.

The management team needs up to date, precise and methodical financial data for the intentions. Financial

statements assist the management in comprehending the progress, prospects, and position of the business

counterpart in the industry.

♦ Importance to the Shareholders: Management is detached from control in the case of companies.

Shareholders cannot take part in the day-to-day business pursuits. However, the outcome of these pursuits

should be disclosed to shareholders during the annual general body meeting in the form of financial statements.

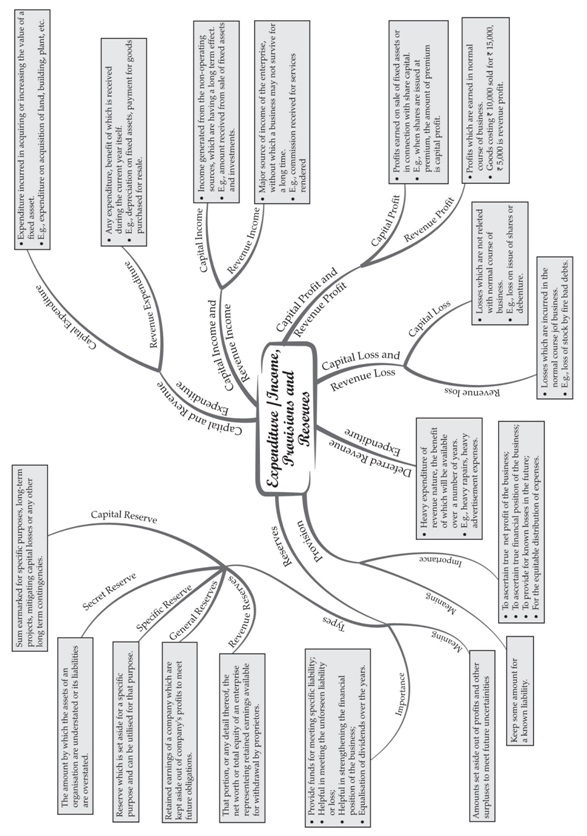

♦ Expenditure:

An expenditure is a payment or the incurrence of a liability in exchange for goods or services. Evidence of the

documentation triggered by an expenditure is a sales receipt or an invoice. Organizations tend to maintain tight

controls over expenditures, to keep from incurring losses.

♦ Capital Expenditure: These are those non-recurring expenditure benefits of which are extended to more

than one accounting year. For example, Expenditure incurred to purchase machinery, the benefits of machinery

would definitely extend to more than one accounting year hence this is a capital expenditure.

Capital expenditures are shown on the assets side of the Balance Sheet.

♦ Revenue Expenditure: These are those recurring expenditures that are incurred for smooth conduct of the

business benefits of which are extended to only one accounting year. Example, Salary paid to the employees,

advertising expenditures, etc. These are shown on the debit side of Trading and Profit and Loss Account.

♦ Deferred Revenue Expenditure:

The expenditure, which is revenue in nature, but the heavy amount spent and benefits likely to be derived over

a number of years called deferred revenue expenditure e.g., heavy expenses on advertising on launching of a new

product and hence it is capitalized like any fixed asset.

♦ Receipts:

Receipts are the cash inflows that may or may not result in obligation to pay in future. On the basis of this nature,

receipts can be classified as:

♦ Capital Receipt:

Capital receipts are those irregular receipts that don’t affect profit or loss of business; it either increases the

liabilities (raising of loan) or reduces the fixed assets (by sale of fixed assets), so it will be shown in balance sheet.

Capital receipts are not made available for distribution of profit to the owner.

♦ Revenue Receipt:

Revenue receipts are received in the normal and regular course of business like Receipts from sale of goods and

rendering services to customers. Income from non-operating business activities (like income from investment i.e.

interest and dividend received and rent received, Commission and other fees received for non-operating business

etc. These receipts increase profit and shown in the credit side of the Trading and Profit and Loss account.

♦ Trading and Profit and Loss Account:

A business needs to prepare a trading and profit and loss account first before moving on to the balance sheet.

Trading and profit and loss accounts are useful in identifying the gross profit and net profits that a business earns.

The trading and profit and loss account are two different accounts that are formed within the general ledger.

The two parts of the account are:

1. Trading Account

2. Profit and Loss Account

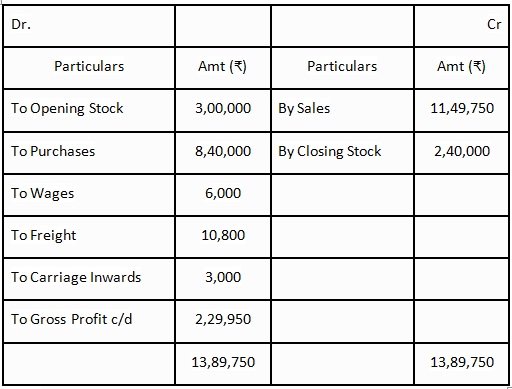

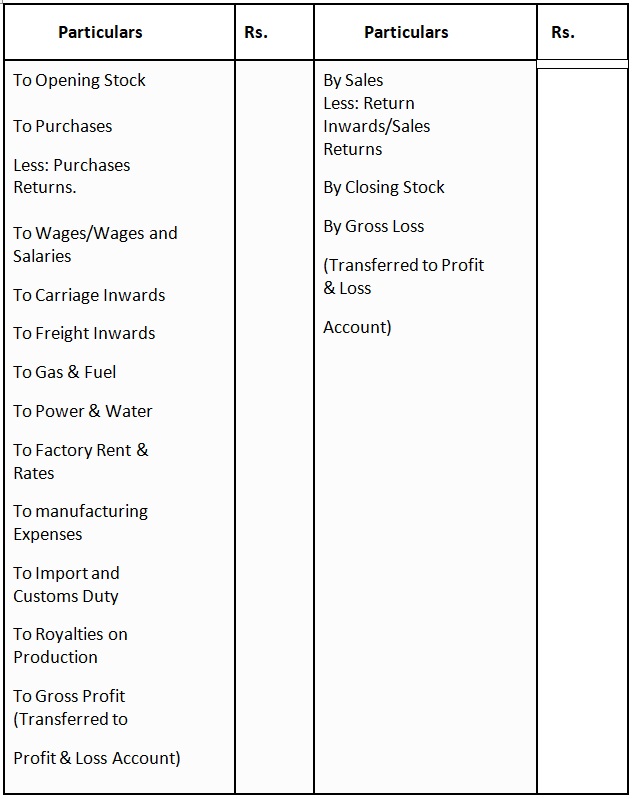

♦ Trading Account:

Trading Account is prepared for calculating the gross profit or gross loss arising or incurred as a result of the

trading activities of a business. Its main components are sales, services rendered, and the cost of goods sold.

Format of Trading Account:

For the year ended………

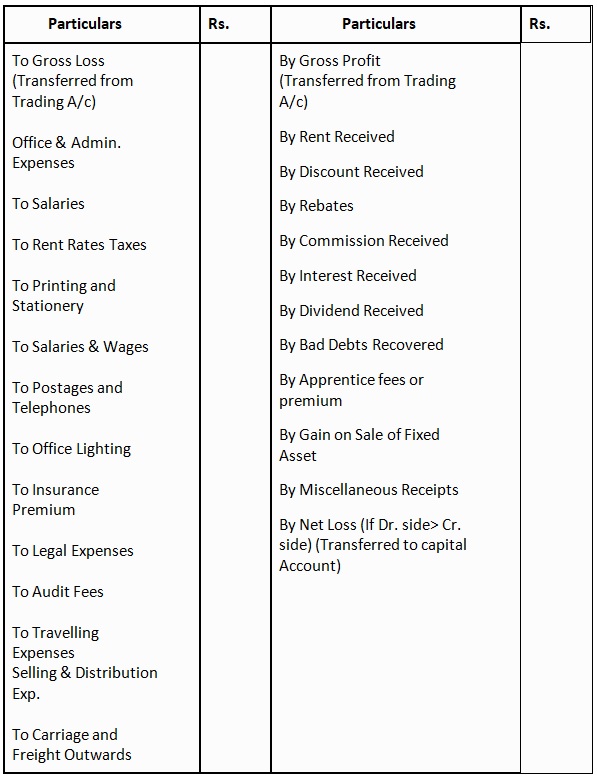

Profit and Loss Account

Profit and loss account shows the net profit and net loss of the business for the accounting period. This account

is prepared in order to determine the net profit or net loss that occurs during an accounting period for a business

concern.

Format of Profit and loss Account:

For the Year Ended …..

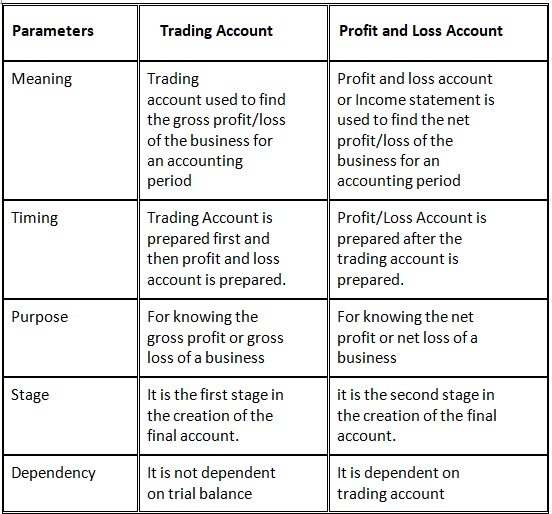

Difference between Trading and Profit and Loss Account:

The following points of difference exist between the Trading and Profit and Loss Account

♦ Gross Profit:

Gross Profit is the excess of Net Sales over the Net Purchases and Direct Expenses incurred for producing

those goods.

Gross Profit = Net Sales - (Net Purchases + Direct expenses)

If the Net Sales is less than the sum of net purchases and direct expenses it results in Gross Loss. The Gross

Profit/Loss is transferred to Profit and Loss Account.

When Cr side is less than Dr side, or the excess of sales over purchases and direct expenses is called gross

profit. If the amount of purchases including direct expenses is more than the sales revenue, the resulting

figure is ‘gross loss.

♦ Net Profit:

If the total of the debit side of the Profit and Loss account that depicts the expenses is more than the credit

side, it results in Net loss and if the total of the debit is less than the credit side then it is the Net Profit for

the period.

Net Profit = Gross Profit + Other Incomes – Indirect Expenses

The Net Profit/loss so computed is transferred to the Capital account in the liabilities side of the balance sheet.

♦ Operating Profit (EBIT):

If the operating revenue is more than the operating expenses, it results into operatingprofit. It is that profit

that is earned through the normal operations of the business.

Operating Profit = Net Profit + Non-Operating Expenses- Non-Operating Incomes.

♦ Balance Sheet:

A balance sheet is a summarised statement of assets and liabilities that is prepared at the end of the financial

year. It is made to show the financial position of the business or the organisation. All the assets are placed on

the right side of the balance sheet and all the liabilities at the left side.

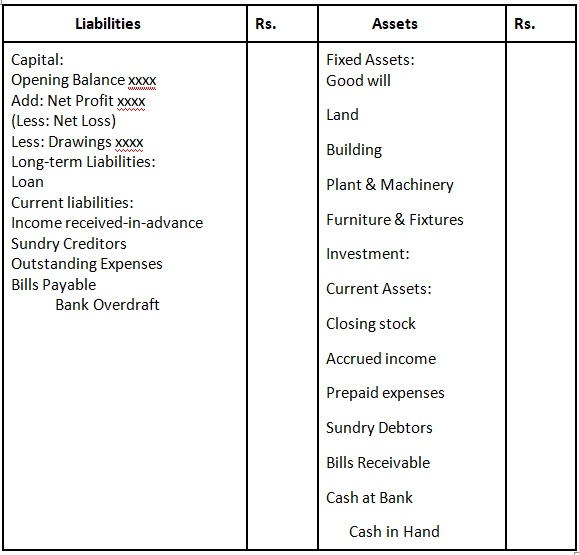

Format of Balance sheet:

Balance Sheet of ………… As at…………

♦ Grouping and Marshalling of Balance Sheets:

Grouping means putting items of similar nature under a common heading. The arrangement of assets

and liabilities in a particular order in the Balance Sheet is called ‘Marshalling’

♦ Marshalling of Balance Sheet can be made in two ways:

1. In order of Liquidity: According to this method, an asset which is most easily convertible into cash such

as cash in hand is written first and then will follow those assets which are comparatively less easily convertible,

so that the least liquid assets such as goodwill, is shown last.

2. In order of Permanence: This method is just opposite to the first method. Assets that are most difficult to be

converted into cash such as Goodwill are written first and the assets which are most liquid such as cash in hand

are written last.

Important Questions

Multiple Choice Questions-

Q1. The object of non – trading concerns-

(a) Social service

(b) Profit earning

(c) Both of these

(d) None of the above

Q2. Closing stock is generally valued at ………….?

(a) Cost Price

(b) Market Price

(c) Cost price or Market price whichever is higher

(d) Cost price or Market price whichever is lower

Q3. Depreciation is necessary to calculate:

(a) Net profitcorrect

(b) Net financial position

(c) Tax

(d) None of them

Q4. Which of the following is correct:

(a) Operating profit = Operating profit – Non-operating expenses – Non-operating incomes

(b) Operating profit = Net profit + Non-operating expenses + Non-operating incomes

(c) Operating profit = Net profit + Non-operating expenses – Non-operating incomes

(d) Operating profit = Net profit – Non-operating expenses + Non-operating incomes

Q5. Trading Account discloses-

(a) Gross profit

(b) Net profit

(c) Net loss

(d) Gross profit or Gross loss

Q6. Direct Expenses are entered in:

(a) Trading Account

(b) profit & Loss Account

(c) Balance sheet

(d) None of these

Q7. Profit and loss Account discloses:

(a) Gross profit

(b) Gross profit or Gross loss

(c) Gross profit or Gross loss

(d) None of these

Q8. Goodwill is a-

(a) Fixed Asset

(b) Current Asset

(c) Fictitious Asset

(d) None of these

Q9. Drawing is deducted from:

(a) Sales

(b) Purchase

(c) Returns outward

(d) Capital

Q10. Every adjusting entry affects?

(a) Income statement account only

(b) Balance sheet account only

(c) Both A & B

(d) None

Very Short-

1. Define financial statement?

2. Which are the statement that is included in the financial statement?

3. What is a trading account?

4. What do you mean by gross profit?

5. State the formula to calculate operating profit from net profit.

6. State the formula to calculate the cost of goods sold.

7. Define Net profit?

Short Questions-

1. Define Balance Sheet?

2. Give two characteristics of the balance sheet.

3. What is primary objective of financial statements?

4. What is the operating profit?

5. What is meant by marshalling of assets and liabilities?

6. What do we come to know by preparing a trading account?

7. Calculate gross profit when total purchases during the year are Rs. 8,00,000; returns outward Rs. 20,000; direct

expenses Rs. 60,000 and 2/3rd of the goods are sold for Rs. 6,10,000.

Long Questions-

1. Calculate Closing Stock from the following details:

Rate of Gross Profit on cost

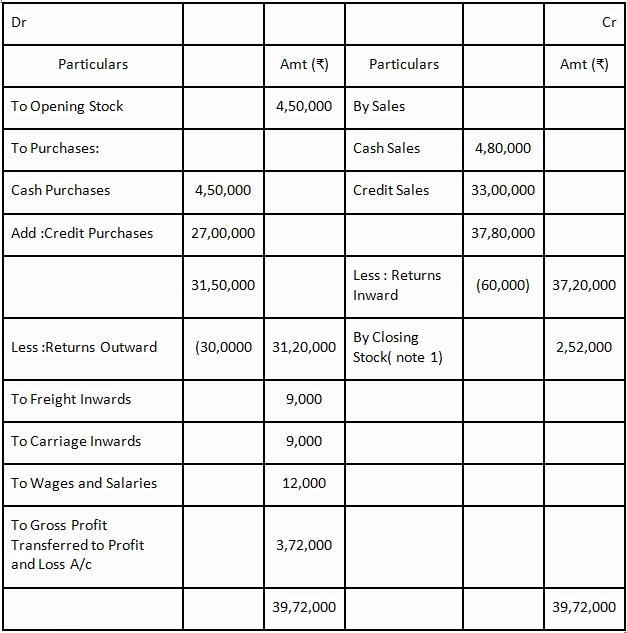

2. From the following information, prepare trading account for the year ended 31st March, 2013 Cash purchases

Rs. 4,50,000; credit purchases Rs. 27,00,000; returns inward Rs. 60,000; cash sales Rs. 4,80,000; credit sales

Rs. 33,00,000; returns outward Rs. 30,000; freight inwards Rs. 9,000; carriage inwards Rs. 9,000; wages and

salaries Rs. 12,000; opening stock Rs. 4,50,000; closing stock Rs. 2,64,000 but its market value is Rs.2,52,000.

3. From the following information, prepare the trading account for the year ended 31st March, 2013

Answer key

MCQ Answers-

1. Answer: (a) Social service

2. Answer: (d) Cost price or Market price whichever is lower.

3. Answer: (a) Net profitcorrect.

4. Answer: (c) Operating profit = Net profit + Non-operating expenses – Non-operating incomes.

5. Answer: (d) Gross profit or Gross loss

6. Answer: (a) Trading Account

7. Answer: (b) Gross profit or Gross loss.

8. Answer: (a) Fixed Asset

9. Answer: (b) Purchase

10. (c) Both A & B

Very Short Answers-

1. Financial statement is a statement which presents financial profit data and financial status of a company.

2. Ans. The two statements that are included in the financial statements are:

• Balance Sheet

• Income Statement (Trading and Profit and Loss A/c)

3. A trading account is a financial statement that shows the result of the purchase and selling of goods

and services of an accounting year.

4. Ans.Gross profit is the surplus of a selling price of a product over the cost of goods sold.

5. Ans. Operating Profit = Net Profit – Non-Operating Income + Non-Operating Expenses.

6. Ans.Cost of goods sold = Sales – Gross Profit

Or

Cost of goods sold (COGS) = Opening Stock + Purchases + Direct Expenses – Closing Stock

7. Ans. Net profit refers to the surplus of all the revenues overall expenses and losses of a company.

Short Answers-

1. A Balance Sheet is a statement which shows the liabilities, assets and shareholder’s equity of the

enterprise. This statement comprises of 2 major groups in which it is categorized, namely, assets,

which is classified into Non – Current Assets and Current assets. Current Assets are such assets which

are easily transformed into cash. On the other hand, the Non – Current Assets are such types of assets

with the assistance of which the enterprise operates the enterprise.

2. The two characteristics of the balance sheet are.

• Determine the financial position of the enterprise on a specific date

• The total of two sides of the balance sheet i.e. assets and liabilities should tally with each

other, if not so it indicates any possible errors in accounting.

3. Ans. The primary objective of financial statements is to analyze the financial position of the business

by comparing them and drawing out the suitable measures to overcome the shortcomings.

4. Operating profit means the excess of operating revenue over operating expenses. It is obtained by

subtracting operating expenses and adding operating incomes to the Gross profit.

5. Ans. Marshalling is the arrangement of assets and liabilities in particular order in the balance sheet in

order to make the balance sheet more scientific and comprehensive for study by the users.

• Marshalling as per Order of liquidity

• Marshalling as per Order of permanence

6. By preparing the trading account, we come to know the ‘gross profit’ earned or ‘gross loss’ sustained by

the firm during the manufacturing or production process.

7. Cost of Goods Sold = Total Purchases – Returns Outward + Direct Expenses = 8,40,000.

• goods sold (2/3)for Rs. 6,10,000.

• Cost of 2/3rd goods = 8,40,000 × 2/3 = Rs. 5,60,000.

• Gross profit = Goods Sold – Cost of Goods Sold = 6,10,000 – 5,60,000 = Rs. 50,000.

Long Answers-

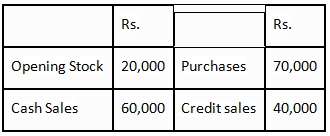

1. Answer

Total Sales = Cash Sales + Credit Sales

= Rs.[60,000 + 40,000] = Rs.1,00,000

Let cost of sales = x

Gross Profit = 33/1/3% of x=x×1/3=x/3

So, Sales = Cost + Gross Profit

x + (x/3) = 1,00,000

4(x/3) = 1,00,000

x = 1,00,000 ×(3/4)cost of goods sold = Rs.75,000

Now Cost of goods sold = Opening Stock + Purchase – Closing Stock

So, [20,000 + 70,000 – Closing Stock] = Rs.75,000

Closing Stock = (20,000 + 70,000) – 75,000 = Rs. 15,000

Goods remaining unsold at the end of the year is called closing stock.

2. Answers

Trading Account

for the year ended 31st March, 2013

i. Closing Stock will be shown in the books at market price or book value price, whichever is less.

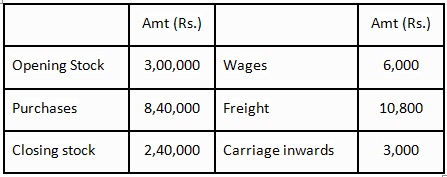

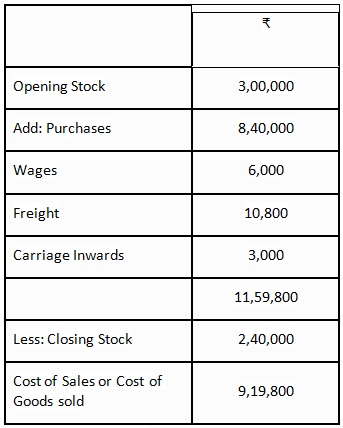

3. Answer: Working Notes :i. Calculation of Cost of goods sold:

ii. Calculation of Sales :

Let us assume that sales = ₹100,

then, gross profit would be = ₹20 (20% of sales)

Therefore, cost of sales would be = Sales – Gross Profit = 100 – 20 = ₹80.

When cost of sales is ₹80, then sales would be = ₹100.

When cost of sales is ₹1, then sales would be =100/80.

When cost of sales is ₹9,19,800, then sales would be =100/80×9,19,800=₹11,49,750.

Trading Account

for the year ended 31st March, 2013