Important Questions

Multiple Choice Questions-

Q.1 What Journal Entry will be passed: Value of asset being sold transferred

to Asset Disposal Account?

a) Asset Disposal A/c Dr

b) Asset A/c Dr

c) Asset A/c Dr

d) Asset Sale A/c Dr

Q.2 Which method of depreciation suffers from the limitation of unequal burden

on profit and loss account?

a) Fixed Instalment Method

b) Reducing Balance Method

c) Depletion Method

d) Annuity method

Q.3 Which method of charging depreciation is accepted by Income Tax Act?

a) Written down value method

b) Both Written down value method and Straight Line method

c) Straight Line method

d) None of the above

Q.4 Depreciation is a process of:

a) Allocation of cost

b) None of the above

c) Valuation of asset

d) Both valuation of asset and allocation of cost

Q.5 Depreciation is which of the following expenditure:

a) Non-cash

b) Both cash and non-cash

c) Cash

d) None of the above

Q.6 Which of the following statements is NOT true about Provisions?

a) It is an appropriation of profit.

b) It is a charge against profits.

c) It is shown on the liability side of Balance sheet.

d) It is discretionary as a matter of financial prudence.

Q.7 Which of the following statements is NOT true about Reserves?

a) It is a charge against profits.

b) It is an appropriation of profit.

c) It is shown on the liability side of Balance sheet.

d) It is discretionary as a matter of financial prudence.

Q.8 If the amount of any known liability cannot be determined with substantial accuracy:

a) A provision should be created.

b) A Contingent liability should be created.

c) A definite liability should be created.

d) A reserve should be created.

Q.9 Under which method the amount of depreciation remains same year after year?

a) Fixed Installment Method

b) Reducing Balance Method

c) Annuity method

d) Depletion Method

Q.10 As per the Original Cost method which is the correct formula for calculating

Annual depreciation?

a) Depreciation = Cost of asset Scrap value/ Estimated life of asset

b) Depreciation = Scrap value - Cost of asset / Estimated life of asset

c) Depreciation = Cost of asset - Market value / Estimated life of asset

d) Depreciation = Cost of asset - Scrap value/ Market value of asset

Very Short-

1. Define Depriciation.

2. What causes depreciation?

3. Give two objectives of Depreciation

4. State the two factors for determining the amount of depreciation

5. What is the scrap value or residual of an asset?

6. What is the formula of a depreciable cost?

7. Define Provisions.

8. State two characteristics of Provisions.

Short Questions-

1. State two characteristics of Provisions.

2. Name the method that assumes that an asset should be depreciated more in the earlier years and less in

later years of use.

3. Charging the whole cost of asset in the first year itself is not correct. Why?

4. Although, written down value method is based upon a more realistic assumption, it suffers from some limitations.

Give any three such limitations.

5. Name and explain different type of reserves in details.

Long Questions-

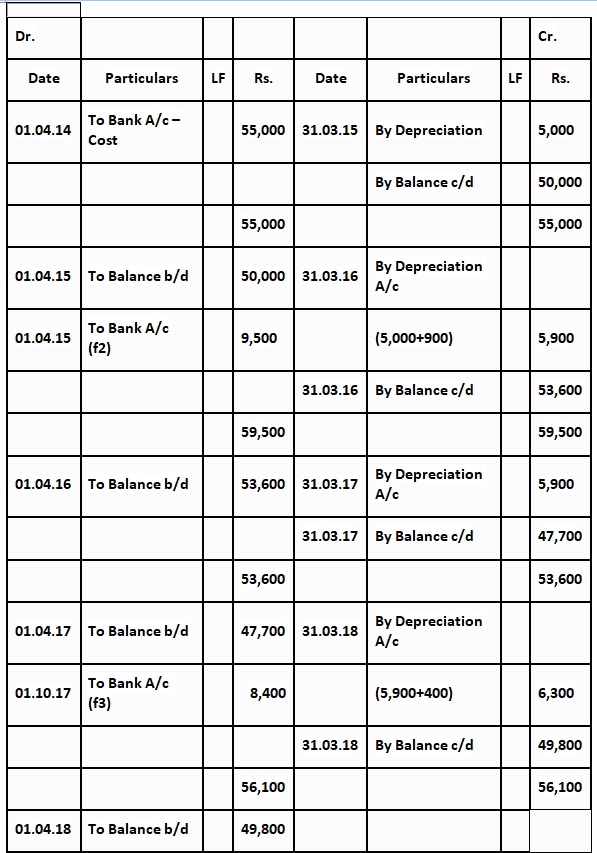

1. On 1st April 2014, merchant purchased furniture costing Rs.55,000. It is estimated that its life is 10 years at the

end of which it will be sold Rs.5,000. Additions are made on 1st April 2015 and 1st October 2017 to the value of

Rs.9,500 and Rs.8,400 (Residual values Rs.500 and Rs.400 respectively). Show the Furniture Account for the first

four years, if Depreciation is written off according to the Straight Line Method.

Case Study Based Question-

Read the following hypothetical text and answer the given questions: -

Arya Ltd. has a manufacturing plant in Delhi. On 1st July, 2021, Arya Ltd purchased a machine for ₹ 1,08,000 and

spent ₹ 12,000 on its installation. At the time of purchase, it was estimated that the effective commercial life of the

machine will be 12 years after which its salvage value will be ₹ 12,000. The machinery is such that the possibility of

obsolescence is low and do not require much repair expenses with passage of time. The accounts are closed on 31st

December every year.

Questions:

1. Which of the following method should be used by Arya Ltd. to charge depreciation?

(a) Written down value method

(b) Straight line method

(c) Insurance policy method

(d) None of the above

2. Why should depreciation be charged on the manufacturing plant of Arya Ltd?

(a) For matching of costs and revenue.

(b) To comply with law.

(c) To reflect true and fair financial position.

(d) All of the above

3. What is the original cost of the asset on which depreciation is to be charged?

(a) ₹1,08,000

(b) ₹12,000

(c) ₹1,20,000

(d) None of these

4. What is the amount of depreciation charged in the first year?

(a) ₹9,000

(b) ₹10,000

(c) ₹4,500

5. Which of the following accounting standard should be followed by Arya Ltd. to charge depreciation?

(a) Accounting Standard-7

(b) Accounting Standard-6

(c) Accounting Standard-8

(d) Accounting Standard-9

Read the following hypothetical text and answer the given questions: -

On 1st April, 2017, X Ltd. purchased a machinery for ₹ 12,00,000. On 1st October, 2019 a part of the machinery

purchased on 1st April, 2017 for ₹ 80,000 was sold for ₹ 45,000 and a new machinery at the cost of ₹ 1,58,000 was

purchased and installed on the same date. The company has adopted the method of providing 10% p.a. depreciation

on the diminishing balance of the machinery. X Ltd. maintains provision for depreciation and machinery disposal

account. You are required to answer the following questions.

Questions:

1. What is the balance carried in the machinery account in March, 2018?

(a) ₹12,00,000

(b) ₹10,80,000

(c) ₹9,60,000

(d) None of these

2. Provision for depreciation will be shown as a current asset by X Ltd. in the balance sheet.

(a) True

(b) False

(c) Partially true

(d) Can’t say

3. What is the accumulated depreciation on the machinery worth ₹ 80,000 that was sold?

(a) ₹8,000

(b) ₹7,200

(c) ₹18,440

(d) None of these

4. Which of the following points need to be kept in mind when provision for depreciation account is maintained?

(a) Asset account continues to appear at its original cost year after year over its entire life

(b) Depreciation is accumulated on a separate account instead of being adjusted in the asset account at the end of each accounting period

(c) Both (a) and (b)

(d) None of the above

5. What is the gain or loss on the sale of machinery worth ₹ 80,000?

(a) ₹16,560 profit

(b) ₹16,560 loss

(c) ₹35,000 loss

(d) ₹35,000 profit

Answer key

MCQ Answers-

Answer: Asset Disposal A/c Dr

Answer: Fixed Instalment Method

Answer: Written down value method

Answer: Allocation of cost

Answer: Non-cash

Answer: It is an appropriation of profit.

Answer: It is a charge against profits.

Answer: A provision should be created.

Answer: Fixed Installment Method

Depreciation = Cost of asset Scrap value/ Estimated life of asset

Very Short Answers-

1. Depreciation is defined as continuing or permanent decrease in the quantity, value, and quality of assets.

2. Ans. Depreciation is caused by

• By constant use

• By the expiry of a time

3. The two objectives of depreciation are

• To determine true profit.

• To create funds for replacement of assets.

4. Ans.The two factors for determining the amount of depreciation are

• The total cost of the asset

• The estimated useful life of the asset

5. Ans. The scrap value or residual of an asset is the estimated sale value of the assets at the end of its useful life.

6. Ans.Principal error can be represented by the following example:

When a purchase of furniture is debited to purchase account instead of a furniture account.

7. Ans. Depreciable Cost= Cost of Asset – Scrap Value

8. The amount retained by way of providing for any unknown liability of which the amount cannot be detained with substantial accuracy.

Short Answers-

1.The two characteristics of Provisions are.

Provision is an amount set aside to meet a future expense.

Provisions are recorded as a current liability in the balance sheet.

2. Ans. Written down value method. It is also known as Reducing Balance or Reducing the Installment

Method or Diminishing Balance Method. Under this method, the depreciation is calculated at a certain

fixed percentage each year on the decreasing book value commonly known as WDV of the asset (book value

less depreciation).

3. Ans. Since this is not in conformity with the matching principle which requires revenues for a given period

to be matched against expenses for the said period. The asset is used for more than one year. So the expenses

of the depreciation also has to be charged for all those years, during which the asset is used.

4. Limitations of the Written Down Value Method

Although this method is based upon a more realistic assumption it suffers from the following limitations

It does not take into consideration the interest on capital invested in the asset.

It does not provide for the replacement of the asset on the expiry of its useful life.

The formula to obtain the rate of depreciation can be applied only when there is a residual value of the asset.

5. Ans. Type of Reserves

Revenue Reserves:- The reserves created from revenue profits which arise out of the normal operating

activities of the business and are otherwise freely available for distribution as dividend are known as revenue reserves.

Revenue reserves can be classified into the following two types of reserves:-

General Reserve:- As suggested by the name the reserves which are not created for a specific purpose is general

reserve. It strengthens the financial position of the business. It is also known as free reserve or contingency reserve.

Specific Reserve:- As suggested by the name, these are the reserves that are created for some specific purpose and

can be utilized only for that purpose. e.g., Debenture Redemption Reserve, Workmen Compensation Fund, Investment

Fluctuation Fund etc.

Capital Reserve:- The reserves which are created out of capital profits and are not available for distribution as dividend

are known as capital reserve. These reserves are kept to prepare the company for any unforeseen event like inflation, instability,

need to expand the business. Capital reserves can be used for writing off capital losses or issue of bonus shares in case of a company.

Capital profit treated as capital reserves e.g. Premium on issue of securities, Profit on redemption of debentures, Profit on reissue of

forfeited shares etc.

Long Answers-

1.Answer

Depreciation = Total cost – scarp value / life of assets Total cost = Amount paid for machineryat the time

of purchase. Scarp value = Sale value of machine at the time of sale Depreciation on 1st Furniture = cost 55,000

& scarp value 5,000 so deprication =(55,000–5,000)/10

= Rs.5,000 per annum

Depreciation on 2nd Furniture = cost 9,500 & scarp value 500 so deprication = Rs.(9,500–500)/10

= Rs.900 per annum

Depreciation on 3rd Furniture = cost 8400 & scarp value 400 so deprication = Rs.(8,400–400)/10

= Rs.800 per annum

Case Study Answer-

Answer:

(b) Straight line method

(c) To reflect true and fair financial position.

(c) ₹1,20,000

(c) ₹4,500

(b) Accounting Standard-6

Answer:

(a) ₹12,00,000

(b) False

(c) ₹18,440

(c) Both (a) and (b)

(b) ₹16,560 loss