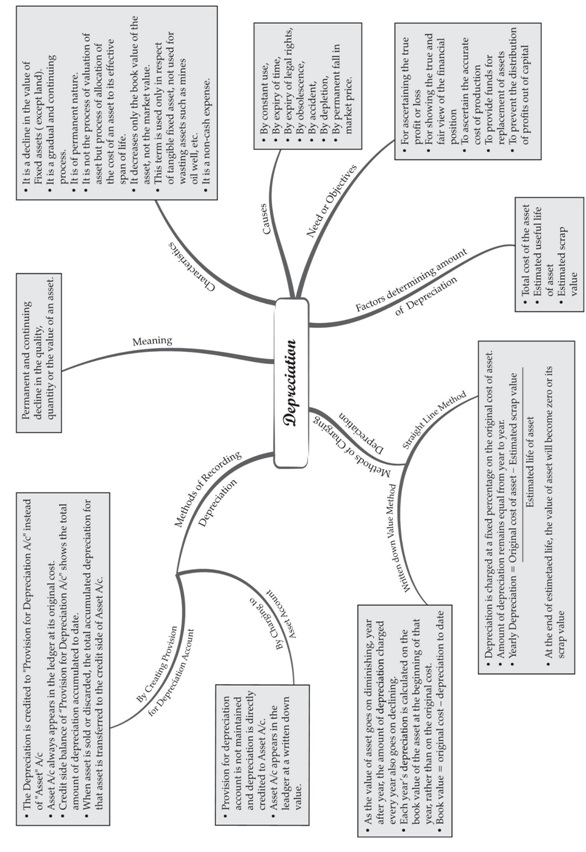

Depreciation, Provisions And Reserves

Meaning of Depreciation

Depreciation means fall in book value of a depreciable fixed asset because of its wear and tear, passage/efflux

of time, obsolescence or accident. It is charged on all fixed assets except land because of its infinite economic life.

♦ Characteristics of Depreciation

• Depreciation is decline in the book value of tangible fixed asset.

• It decreases only the book value of an asset and not the market value of an asset.

• It is a non-cash expense as it does not involve cash.

• It is permanent, gradual and continuous in nature.

• It is an expense and therefore is debited to the profit and loss account.

• It is the process of writing off the capital expenditure which has already been incurred over its useful life.

• It is a process of allocation of cost of an asset to its useful life span and not the process of valuation of asset.

• It is only used for tangible fixed asset and cannot be used for wasting and fictitious assets. For example, depletion

of natural resources and amortisation of goodwill.

♦ Concepts Related to Depreciation

• Depletion: It is related to the extraction of natural resources such as quarries and mines which leads

to decline in the availability of the quantity of asset or material.

• Amortisation: Writing off the cost of intangible assets such as trade mark, copyright and patents over its useful

life is known as amortisation.

• Obsolescence: Obsolescence means decrease in the value of asset because of innovation or improved technology,

change in taste or fashion or inadequacy of the existing asset because of the improved demand.

♦ Causes of Depreciation

• Use of asset i.e. wear and tear: There exists a normal wear and tear because of constant use of fixed assets

which leads to fall in the value of the assets.

• Passage/efflux of time: Whether assets are used or not, with the passage of time, its effective life will decrease.

• Obsolescence: Because of new technologies, innovations and inventions, assets purchased today may become

outdated by tomorrow which leads to the obsolescence of fixed assets.

• Accidents: An asset may lose its value because of mishaps such as a fire accident, theft or by natural calamities

and are permanent in nature.

♦ Need for Providing Depreciation

• To ascertain the true profit or loss: True profit or loss can be ascertained when all the expenses and losses incurred

for earning revenues are charged to profit and loss account. Assets are used for earning revenues and its cost is charged

in the form of depreciation from profit and loss account.

• To show true and fair view of the financial position: If depreciation is not charged, assets will be shown at a higher

value than their actual value in the balance sheet. Consequently, the balance sheet will not reflect true and fair view

of financial statements.

• To retain out of profit funds for replacement: Unlike other expenses, depreciation is a non-cash expense. So, the amount

of depreciation debited to the profit and loss account will be retained in the business. These funds will be available for

replacement of fixed assets when its useful life ends.

• To ascertain correct cost of production: Depreciation on the assets, which are engaged in production, is included in

the cost of production. If depreciation is not charged, the cost of production is underestimated which will lead to low

selling price, and thus leads to low profit.

• To comply with legal requirement: To comply with the provisions of the Companies Act and Income Tax Act, it is necessary

to charge depreciation.

♦ The factors involved in providing depreciation are

• Historical (Original) cost of the asset: The total cost of an asset is taken into consideration for ascertaining

the amount of depreciation. The total cost of an asset includes all expenses incurred up to the point where the asset

is ready for use such as freight expenses and installation charges.

Total cost =Purchase price+ Freight expenses+ Installation charges

• Estimated net residual value: It is estimated as the net realisable value of an asset at the end of its useful life.

It is deducted from the total cost of an asset and the difference is written off over the useful life of the asset. For

example, furniture acquired at ₹1,30,000 has its useful life estimated to be 10 years and its estimated scrap value is ₹10,000.

Depreciation per annum = 1,30,000–10,000/10 years= ₹12,000

• Estimated useful life: Every asset has its useful life other than its physical life (in terms of number of years, units)

used by a business. The asset may exist physically but may not be able to produce the goods at a reasonable cost. For example,

an asset is likely to lose its useful value within 15 years; its useful life i.e. life for purpose of accounting should be considered as only 15years.

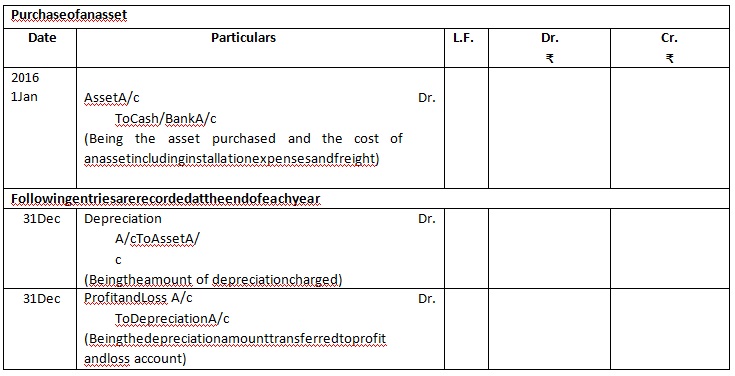

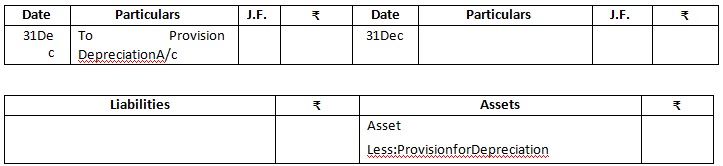

Methods of Recording Depreciation

In the books of account, following are the two methods of recording depreciation of fixed assets:

• When depreciation is charged or credited to the assets account.

• Whendepreciation is credited to provision for depreciation/accumulated account.

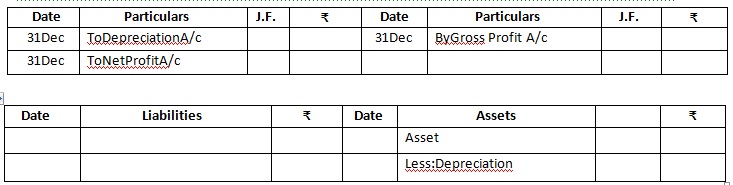

When Depreciation is Charged or Credited to the Assets Account

In this method, depreciation is deducted from the asset value and charged (debited) to profit and loss account.

Hence, the asset value is reduced by the amount of depreciation.

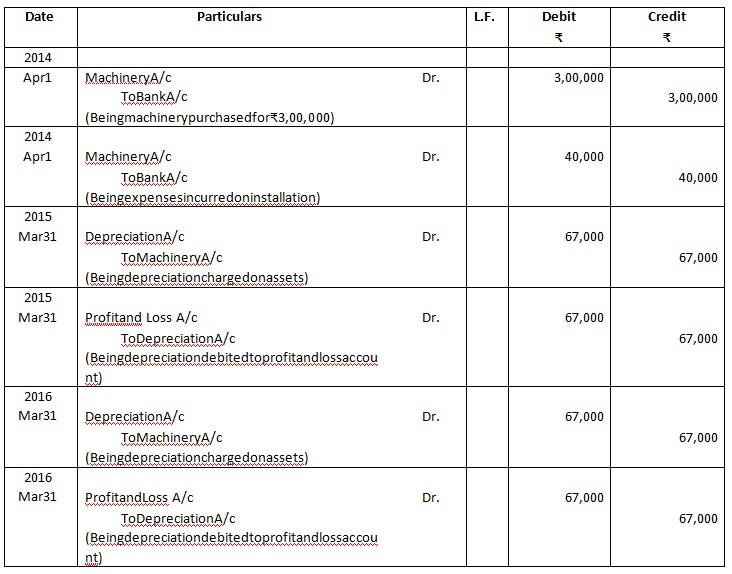

Journal entries for recording under this method are as follows:

Journal

In the balance sheet, asset appears at its written down value which is cost less depreciation charged till date.

In this method, the original cost of an asset and the total amount of depreciation which has been charged cannot

be ascertained from this balance sheet.

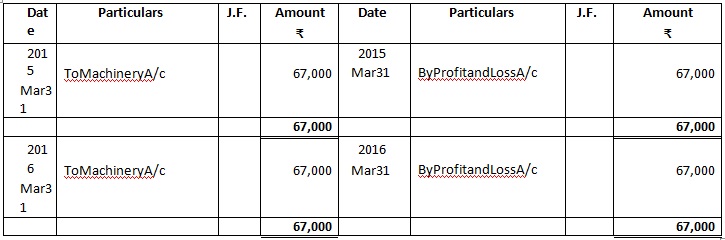

ProfitandLoss Account

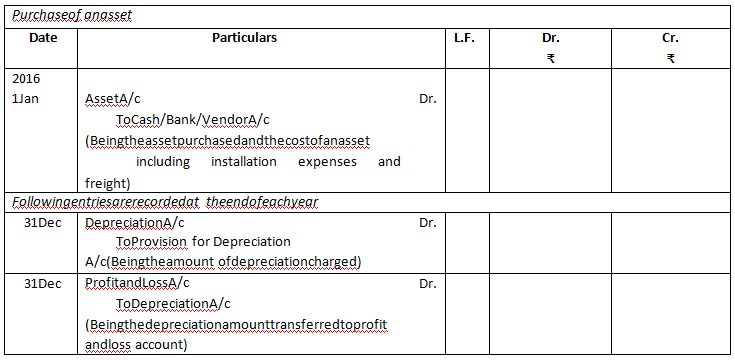

When Depreciation is Credited to Provision for Depreciation Account

In this method, depreciation is credited to the provision for depreciation account or accumulated depreciation

account every year. Depreciation is accumulated in a separate account instead of adjusting into the asset account

at the end of each accounting period. In the balance sheet, the asset will continue to appear at the original cost

every year. Thus, the balance sheet shows the original cost of the asset and the total amount of depreciation charged

on asset.

Journal entries for recording under this method are as follows:

ProfitandLoss Account

Dr. Cr.

Depreciation Account and Provision for Depreciation Account

Methods of Depreciation

♦ The two methods of depreciation are

• Fixed percentage on original cost or straight line method.

• Fixed percentage on diminishing balance or written down value method.

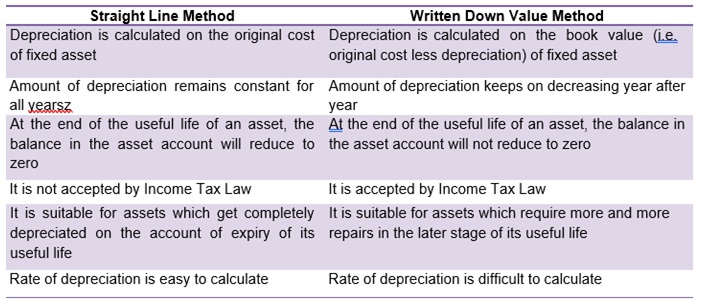

♦ Straight Line Method

According to this method, a fixed and equal amount is charged as depreciation for every accounting period during

the life time of an asset. This method is based on the assumption of equal usage of time over asset’s entire useful life.

Hence, the amount of depreciation is same from period to period over the life of the asset.

♦ Depreciation amount can be calculated by using the following formula:

If the asset has a residual value at the end of its useful life, the amount to be written of every year is as follows:

Depreciation = Cost of asset – Estimated net residual value / No. of years of expected life

If the annual depreciation amount is given then we can calculate the rate of depreciation as follows:

Rate of depreciation = Annual depreciation amount / Cost of asset * 100

♦ Advantages of Straight Line Method

• Simple to calculate the depreciation amount.

• Assets can be depreciated up to the estimated scrap value.

• Easy to understand the amount of depreciation.

• Every year, the same amount of depreciation is debited to profit and loss account, and hence the effect on profit

and loss account will remain the same.

♦ Disadvantages of Straight Line Method

• Interest on capital invested in assets is not provided in this method.

• Over the years, the work efficiency of assets decreases and repair expenses increases. Therefore, there is burden

on the profit and loss account.

• Book value of the assets becomes zero but still the assets are used in the business.

♦ Illustration

Pokemon and Brothers purchased a Machinery for ₹3,00,000 on April 01,2014 and spent ₹40,000 for its installation.

The salvage value of the machine after its useful life for 5 years, is estimated to be ₹5,000. Record journal entries for the

year 2014-2015 and draw up Machine Account and Depreciation Account for first 2 years given that the depreciation is

charged using straight line method if the books of accounts close on March 31 every year and the firm charges depreciation

to the asset account.

BooksofPokemonandBrothers

Journal Entries

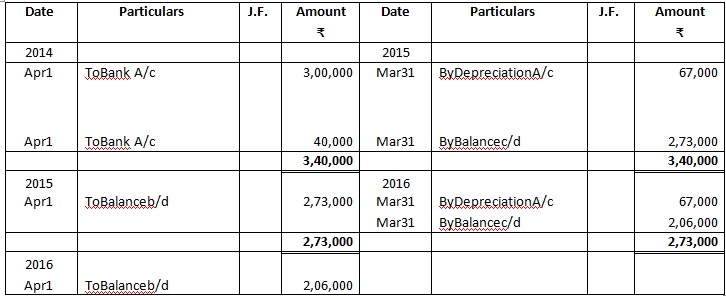

MachineryAccount

DepreciationAccount

Working Notes

Original Cost of Machinery = ₹3,00,000 + ₹40,000 = ₹3,40,000 Salvage value= ₹5,000

Life of asset= 5 years

Depreciation per annum= ₹3,40,000 – ₹5,000/5

= ₹67,000

Written Down Value Method

In this method depreciation is charged on the book value of the asset and the amount of depreciation reduces

year after year. It implies that a fixed rate on the written down value of the asset is charged as depreciation every

year over the expected useful life of the asset. The rate of depreciation is applicable to the book value but not to the

cost of asset.

Rate of depreciation can be ascertained on the basis of cost, scrap value and useful life of the asset as follows:

Where, R is the rate of depreciation in percent, n is the useful life of the asset; S is the scrap value at the end of

useful life and C is the cost of the asset.

Advantages of Written Down Value Method

• The profit and loss account of depreciation and repair expenses has same weightage throughout the useful

life of asset because depreciation decreases with an increase in repair expenses.

• Since the benefits from asset keep on decreasing, the cost of asset is allocated rationally.

• This method is most favorable for those assets which require increased repairs and maintenance expenses over the years.

• This method is widely accepted under the Income Tax Act.

Disadvantages of Written Down Value Method

• The value of assets can never be zero even though it is discarded.

• In this method, it is difficult to calculate depreciation.

• There is no provision of interest on capital invested in use of assets.

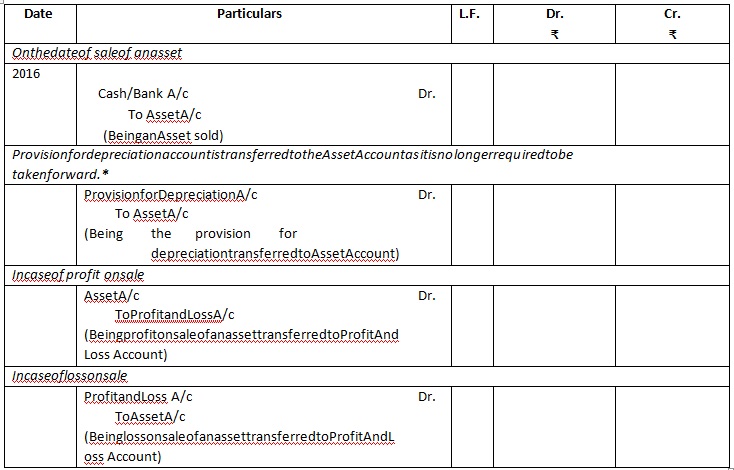

Sale of an Asset

Sometimes an asset may be sold before the completion of its useful life because of obsolescence, inadequacy or for

any other reason. In this case, there may be gain on sale of asset if the sale proceeds are greater than the written down

value of the asset on the date of sale or loss on sale if the sale proceeds is lesser than the written down value of the asset

on the date of sale. Then these profit or loss on sale of asset is transferred to profit and loss account.

Accounting entries for recording the sale of an asset are as follows:

Journal

*Note: Onlywhentheprovisionfordepreciationaccount ismaintained,entrywillbepassed.

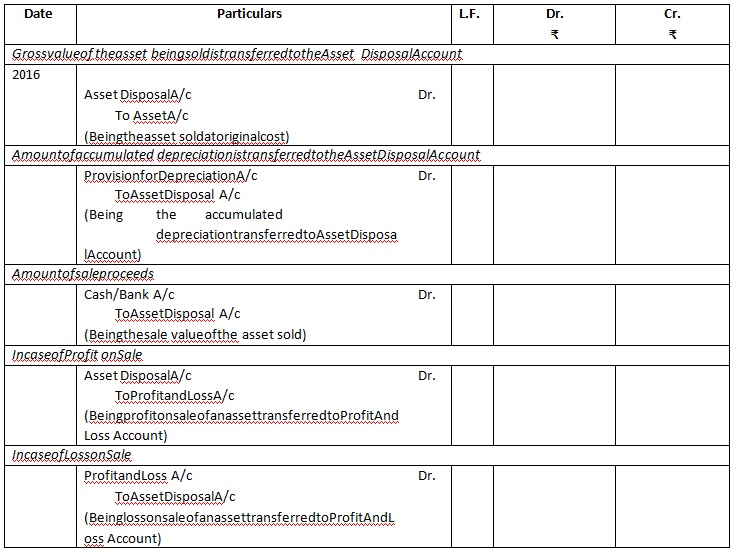

Disposal of an Asset

A new account is opened named Asset Disposal A/c at the time of sale of an asset. This account is opened in the

ledger to calculate profit or loss on sale of an asset.

FollowingjournalentriesrequiredforpreparationofAssetDisposalA/c

A. Whenprovisionfordepreciationaccountismaintained.

Journal

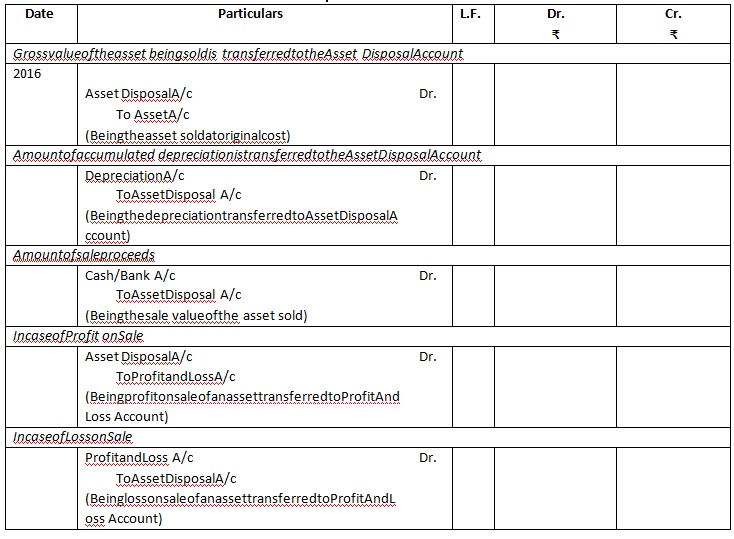

B. When provision for depreciation account is not maintained.

DifferencebetweenStraightLineandWrittenDownValueMethod

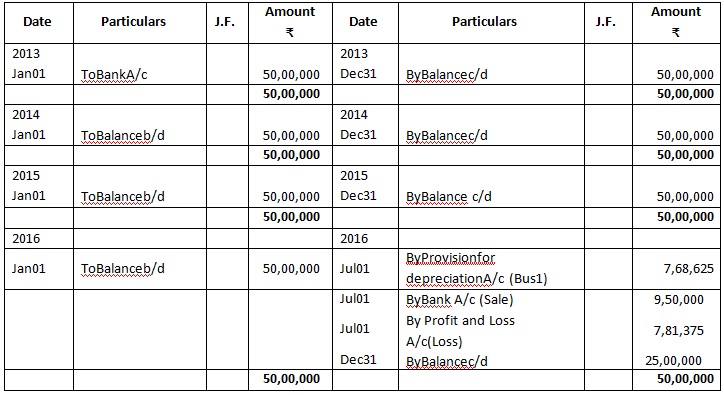

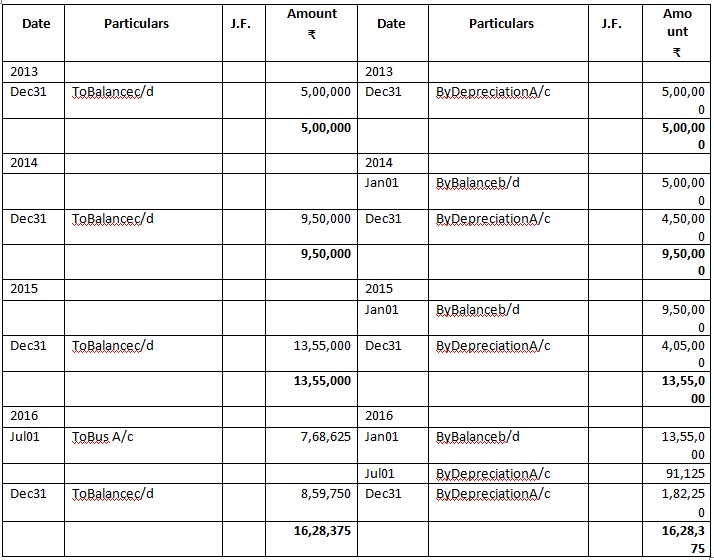

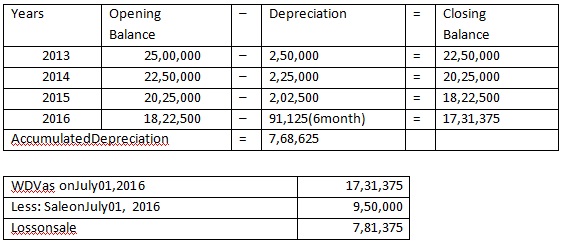

Illustration

On January 01, 2013, Vighneshwar Travels, purchased 2 Buses for ₹25,00,000 each. On July 01, 2016,

one of the bus which was purchased on January 01, 2013 was sold for ₹9,50,000. Prepare Bus account

and Provision for Depreciation account from the year 2013 to 2016, if depreciation is written off @10%

p.a. on diminishing balance method. Books are closed on December 31 every year.

BooksofVighneshwarTravelsBusAc

count

ProvisionforDepreciationAccount

Dr. Cr.

Working Notes:

Provision and its Importance

Provision is an amount which is set aside by charging it to profit for the purpose of providing for any known

liability or uncertain loss or expense. The amount of which cannot be determined with certainty is also referred

to as provision. Few examples are provision for depreciation, provision for doubtful debts and provision for discount

on bad debtors.

The main objective of provision is to account all expenses and losses. Through the creation of provision account, the

amount of liability, losses and expenses are estimated and accounted for the accounting

period. Therefore, the true profit and loss is ascertained, liabilities and assets are presented with correct values

♦ Features

• It is an amount kept aside, out of income or profit, to meet the known liability.

• It is retention of profit made for the time being and specific reason such as known depletion in the value of the asset,

anticipated loss occurred but the amount is not ascertained and a liability has been known to have arisen.

• At the time accounting, an appropriate amount of anticipated loss in the value of the asset or the liability is not ascertained.

• It is a charge to profit and loss account.

♦ ImportanceofProvision

• To meet anticipated losses and liabilities: Provision is created to meet the anticipated losses andliabilities such

asprovision for doubtful debts, provision for discount on debtors and provision fortaxation.

• To meet known losses and liabilities: Provision is created to meet known losses and liabilities suchasprovisionfor

repairs andrenewals.

• To present correct financial statements: To present a true and fair view of profit and financialstatement, thebusiness

mustmaintainprovisionforknownliabilities andlosses.

Therefore, provision is necessarily to be created to ascertain the current income or profit.

Also, it is considered as a charge against revenue or profits.

Accounting Treatment

Provision is a charge against the profit which is debited in the profit and loss account. In the balance sheet, the

amount of provision may be shown on the asset side by deducting from the relevant asset or on the liability side along

with the current liabilities.

• Treatment on asset side– Provision for doubtful debts is deducted from the amount of sundry debtors and the provision

for depreciation is deducted from the relevant asset.

• Treatment on liability side– Provision for repairs and charges are shown along with the current liabilities.

Reserves and its Importance

Reserves

Reserve is an amount set aside from the profit other than surplus which is retained by the business to meet future

contingencies. It is an appropriation of profit and not a charge against profit, and therefore is shown in the profit and

loss appropriation account.

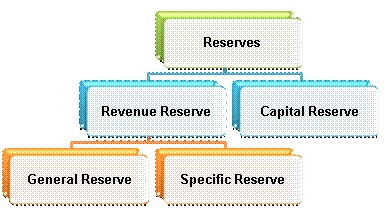

Types of Reserves

♦ Revenue Reserve: It is an amount set aside out of revenue profits for distribution of dividends. For example,

general reserve, investment fluctuation fund, capital reserve and workmen compensation fund. It is not a charge

against profit but it is appropriation of profit shown in the profit and loss account. It is beneficial for the smooth

function of the business. The retention of profit in the form of reserves reduces the amount of profit to distribute

among the business owners. This is further classified in to general reserve and specific reserve.

• General reserve means a reserve which is not maintained for specific purpose. It helps to strengthen the financial

status of the business. It is also known as free reserve and contingency reserve.

• Specific reserve means a reserve which is maintained for specific purpose. For example, dividend equalisation reserve

is created to maintain dividend rate. This reserve amount is utilised to maintain the rate dividend in the year of low profit.

Likewise, the workmen compensation fund is maintained to provide claims of the workers, investment fluctuation fund is

used at times of decline in the value of investment and debenture redemption reserve is used to provide funds for redemption

of debentures.

♦ Capital Reserve: It is an amount set aside out of capital profits which is not available for distribution as dividend

among the shareholders. It is used for writing capital losses/issue of bonus share in a company. Examples of capital

reserves are

• Profit prior to incorporation

• Premium on issue of shares or debentures

• Profit on redemption of debenture

• Profit on forfeiture of share

• Profit on sale of fixed assets

• Capital redemption reserve

• Profit on revaluation of fixed assets and liabilities

♦ Importance of Reserves

• It strengthens the financial position of an enterprise

• It helps meet the purpose of future contingency

• It assists the expansion of business operation or to bring consistency in distribution of dividend.

• It creates reserves for investment allowance reserve

Accounting Treatment

Reserves are not a charge against profit but are the appropriation of profits. Therefore, reserves are transferred

to the debit side of profit and loss appropriation account. In the balance sheet, it is shown on the liability side under

the heads of reserves and surplus.

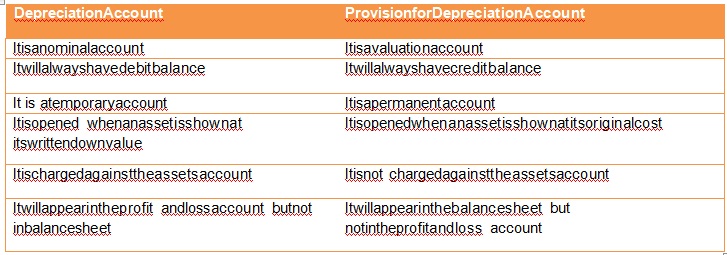

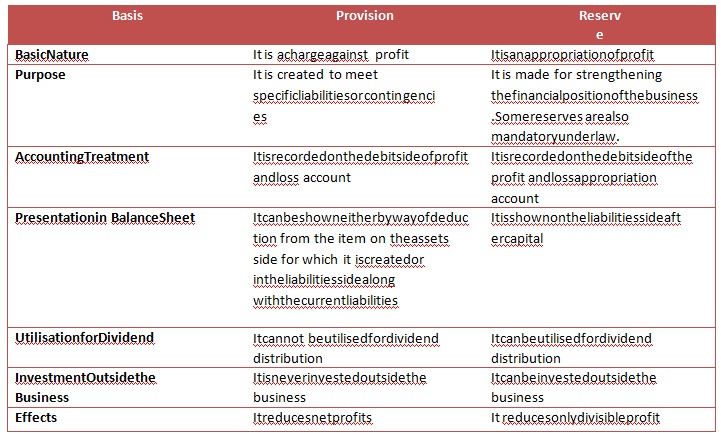

Provisions and Reserves

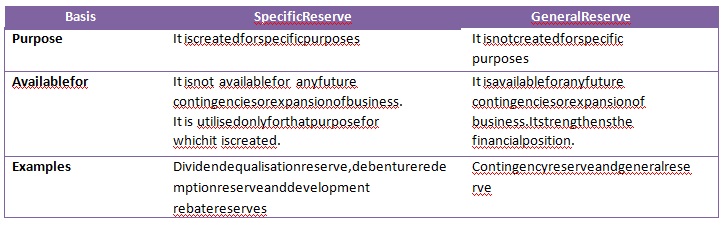

Specific Reserve and General Reserve

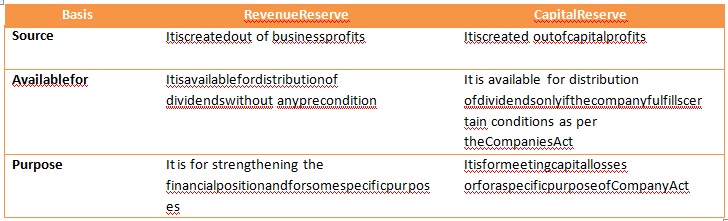

Revenue Reserve and Capital Reserve