Important Questions

Multiple Choice Questions-

Q.1 Credit balance as per pass book is?

(a) Unfavorable balance

(b) Favorable balance

(c) Both a & b

(d) None

Q.2 The balance on the debit side of the bank column of cash book indicates?

(a) The total amount has drawn from the bank

(b) Cash at bank

(c) The total amount overdraft in the bank

(d) None of above

Q.3 Which of the following would not affect bank reconciliation?

(a) Dishonored cheque

(b) Discount received

(c) Bank interest

(d) Check not presented

Q.4 When cash is deposited into bank then the following account would be debited

in the company accounts?

(a) Cash account

(b) Overdraft account

(c) Bank account

(d) None

Q.5 Overdraft means _______ balance of Cash Book.

(a) closing

(b) debit

(c) opening

(d) credit

Q.6 A statement which is used to reconcile the bank balance as per cash book and bank

statement is called:

(a) Financial Statement

(b) Bank Reconciliation Statement

(c) Bank Statement

(d) Income Statement

Q.7 Debiting an entry in Cash Book ___________ cash balance.

(a) increases

(b) decreases

(c) nullifies

(d) none of the above.

Q.8 A pass book is a copy of

(a) A customer’s account in the bank’s books

(b) Cash book relating to bank column

(c) Cash book relating to cash column

(d) Firm’s receipts and payments

Q.9 Bank reconciliation statement is prepared by:

(a) Banker

(b) Accountant

(c) Auditor

(d) None of these

Q.10 Any decrease in the bank balance is recorded on ____ side of Cash Book and in

____ Column of Pass Book.

(a) Debit; Credit

(b) Credit; Debit

(c) None of the given options

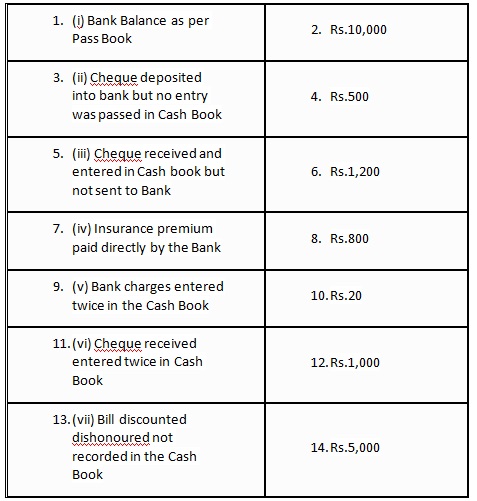

Very Short-

1. Define the bank reconciliation statement

2.What do you mean by a debit balance in Passbook?.

3. State two reasons for the difference between the company’s cash book and bank balance?

4. Why is the bank reconciliation statement important?

5.Which balance is caused an overdraft of cash book and passbook?

6. Mention two items drafted in a plus column while starting with a debit balance of cash book.

Short Questions-

1. Mention two items drafted in a minus column while starting with a debit balance of cash book?

2. Mention two items drafted in a minus column while starting with an overdraft balance of cash book.

3. Mention two items drafted in a plus column while starting with an overdraft balance of cash book.

4. What does favourable balance in passbook indicate?

5. What is meant by debit balance in pass book?

6. What does unfavourable balance in pass book indicate?

7. Briefly explain the statement ‘wrongly debited by the bank’ with the help of an example.

Long Questions-

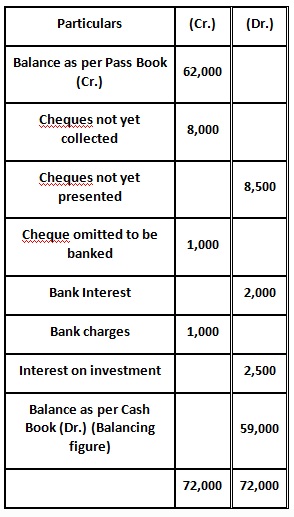

1. Bank Statement of a customer shows a bank balance of Rs.62,000 on 31 March 2018.

On comparing it with the cash book, the following discrepancies were noted

I. Cheques were paid into the Bank in March but were credited in April.

P – Rs.3,500, Q – Rs.2,500. R – Rs.2,000

II. Cheques issued in March were Presented in April

X – Rs.4,000, Q – Rs.4,500

III. Cheque for Rs.1,000 received from a customer entered in the cash book but was not banked

IV. Passbook shows a debt of Rs.1,000 for bank charges and credit of Rs.2,000 as interest

V. Interest on investment Rs.2,500 collected by the bank appeared in the passbook.

Prepare Bank Reconciliation Statement the balance as per cash book on 31 March 2018.

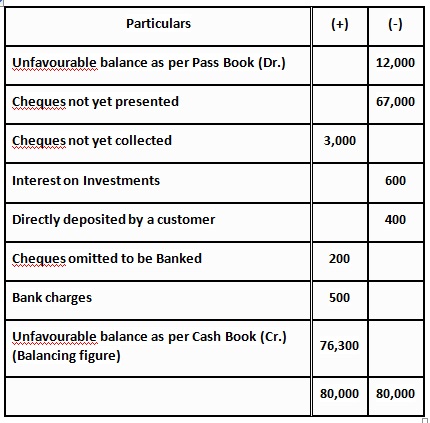

2. Prepare Bank Reconciliation statement on 31st March 2018 from the following particulars:

I. R’s overdraft as per the Pass Book Rs.12,000 as on 31st March

II. On 30th March, Cheques had been issued for Rs.70,000 of which cheques worth Rs.3,000 only had

been encashed up to 31st March.

III. Cheques amounting to Rs.3,500 had been paid into the bank for collection but of this only Rs.500 had

been credited in the Pass Book.

IV. Bank has charged Rs.500 as interest on overdraft and the intimation of which has been received on 2nd April 2018.

V. Bank Pass Book shows credit for Rs.1,000 representing Rs.400 Paid by debtor of R direct into the Bank and Rs.600

collected directly by Bank in respect of interest on R’s investment. R had no knowledge of these items.

VI. A cheque for Rs.200 has been debited in bank column of Cash Book by R, but it was not sent to Bank at all.

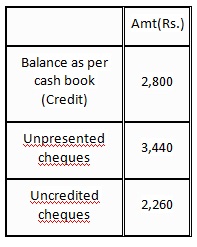

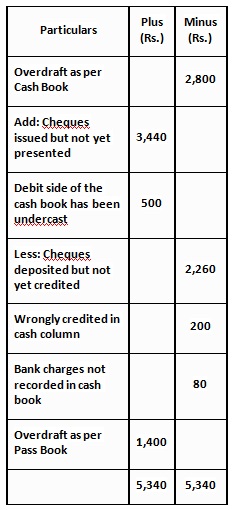

3. Prepare Bank Reconciliation Statement as on 30th September 2016 from the following particulars:

4. The following facts relate to the business of Roshan who requires you to reconcile his cash book with the

pass book balance.

Additional Information

I. The debit side of the cash book (bank column) has been undercast by Rs 500.

II. A cheque of Rs 200 paid to a creditor has been entered by mistake in the cash column.

III. Bank charges Rs 80 have not been entered in the cash book.

Case Study Based Question-

1. Read the following hypothetical text and answer the given questions: -

Vinni has joined as an intern in Elegance Ltd a FMCG company. She has joined under the accounting department.

Her supervisor Ms. Mini works as an accountant in Elegance Ltd. On day 1 of her internship,Vinni is taught how to

prepare a bank reconciliation statement. Vinni is completely new to the topic and wasn’t aware about the need and

procedure for preparation of bank reconciliation statement. Later, Ms Mini explained her the need and procedure for

preparation of bank reconciliation statement and asked her to prepare the bank reconciliation statement for Elegance

Ltd for the month of March 2021.

Questions

1. What documents of Elegance Ltd does Vinni require for preparation of bank reconciliation statement?

(a) Cash book of Elegance Ltd

(b) Pass book of Elegance Ltd

(c) Both (a) and (b)

(d) Neither (a) nor (b)

2. Using which of the following statements would Ms Mini have explained the importance of bank

reconciliation statement to Vinni?

(a) It helps to assure the customer about the correctness of the bank balance shown by the passbook.

(b) It helps the management to keep a track of cheques, which have been sent to the bank for collection.

(c) Embezzlements are avoided by regular periodic reconciliation.

(d) All of the above

3. How would have Ms Mini classified the reasons for differences between cash book and bank book balances?

(a) Timing differences in recording of the transactions.

(b) Errors made by the business or by the bank.

(c) Both (a) and (b)

(d) Neither (a) nor (b)

4. Using which of the following statements would MsMini have explained the need of bank reconciliation

statement to Vinni?

(a) To match the balances as it is generally experienced that when a comparison is made between the

bank balance as shown in the firm’s cash book and the bank statement, the two balances do not tally.

(b) To find out the cash balance.

(c) To understand liquidity position of the firm.

(d) None of the above

5. ‘Debit balance as per pass book and credit balance as per cash book is a favourable balance’.

You are required to answer on Vinni’s behalf whether the above statement is

(a) True

(b) False

(c) Can’t say

(d) Partially true

2. Read the following hypothetical text and answer the given questions: -

On 31st March, 2021, Mr. Dua’s cash book showed a bank balance of ₹ 3,72,000. It differed with the balance shown

in his pass book. A closer scrutiny revealed that there were heques issued to creditors but not yet presented to the bank

for payment amounted to ₹ 72,000. Dividend of ₹ 5,000 was received by the bank but not entered in the cash book.

Interest of ₹ 1,250 was allowed by the bank. Cheques of ₹ 15,400 were deposited into bank for collection but not collected

by bank upto this date. Bank charges amounted to ₹ 200. A cheque of ₹ 320 deposited into bank was dishonoured but no

intimation was received. Bank paid house tax of ₹ 350 on his behalf but no information was received from the bank in this connection.

Questions:

1. Difference caused due to bank charges amounting to ₹ 200, is an example of

(a) timing differences in recording of transactions.

(b) errors made by the business.

(c) errors made by the bank.

(d) None of the above

2. Bank paid house tax of ₹ 350 on his behalf but no information was received from

the bank will lead to

(a) balance in cash book greater than the balance of pass book.

(b) balance in cash book lesser than the balance of pass book.

(c) balance in pass book greater than the balance of cash book.

(d) None of the above

3. Cheques of ₹ 15,400 were deposited into bank for collection but not collected by bank will be

(a) added to debit balance of cash book.

(b) deducted from debit balance of cash book.

(c) ignored.

(d) None of the above

4. Cheques issued to creditors but not yet presented to the bank for payment amounting to

₹ 72,000 will be

(a) added to debit balance of cash book.

(b) deducted from debit balance of cash book.

(c) ignored.

(d) None of the

5. What is the balance of pass book on 31st March, 2021?

(a) ₹ 4,33,980

(b) ₹ 4,50,250

(c) ₹ 3,72,000

(d) None of these

MCQ Answers-

1. Answer: Favorable balance

2. Answer: Cash at bank

3. Answer: Discount received

4. Answer: Bank account

5. Answer: credit

6. Answer: Bank Reconciliation Statement

7. Answer: increases

8. Answer: A customer’s account in the bank’s books

9. Answer: Accountant

10. Credit; Debit

Very Short Answers-

1. Ans. Bank reconciliation statement is a statement that helps the business in matching the bank transactions

recorded in company books with that present in the bank statement. It is useful in checking correctness of recorded

data in books of company and therefore ensures accuracy of bank records.

2. AnsThe debit balance in passbook means overdraft.

3. Ans. The two reasons for the difference between the company’s cash book and bank balance

• Bank issued cheque but not yet presented for payment

• Cheque deposited but not cleared

4. Ans.The bank reconciliation statement is important to determine the cause for the difference made on the

part of the bank or customers side.

5. Ans. Cash book Cr. and Passbook Dr. balances.

6. Ans.The two items drafted in a plus column while starting with a debit balance of cash book are.

• Bank issued cheque but not yet presented for payment

• Interest allowed by the bank but not recorded in the cash book

Short Answers-

1. Ans. The two items

drafted in a minus column while starting with a debit balance of cash book are.

• Cheque deposited but not cleared

• Bank made direct payment from the customer’s side

2. Ans. The two items drafted in a minus column while starting with an overdraft balance of cash book are.

• Cheque deposited but not cleared

• Bank made direct payment from the customer’s side

3. Ans. The two items drafted in a plus column while starting with an overdraft balance of cash book are.

• Bank-issued cheque but not yet presented for payment

• Interest allowed by the bank but not recorded in the cash book

4. Favourable balance in the passbook indicates the actual amount customer has in its account i.e. the Credit balance.

5. Ans. Debit balance in pass book indicates the overdraft i.e. the amount customer has withdrawn over the excess of amount deposited

6. Unfavourable balance as per pass book means the Debit balance as per passbook.

7. Wrongly debited by the bank is an error done by the bank which means that bank has deducted wrong amount from the

account which can be better understood withg thefollowing example:-When a firm issued a cheque of Rs 1,500 to any of its

creditor and it is presented for payment and paid by the bank but in place of Rs 1,500 bank debited it wrongly by Rs 15,000.

The above error may be opposite too but in every situation, the balance of cash book and pass book will not tally. The term

will be used for it will be wrongly debited by the bank, it generally happens at the time of posting the transaction.

Long Answers-

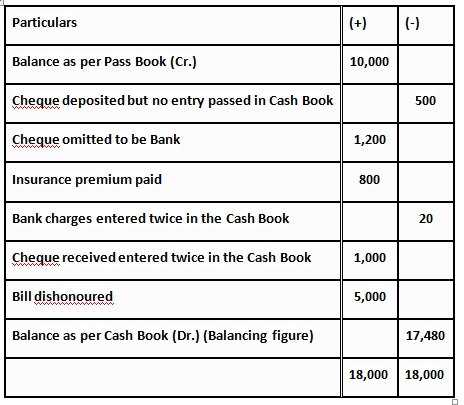

1. Answer - BANK RECONCILIATION STATEMENT

as on March 31, 2018

2. BANK RECONCILIATION STATEMENT

as on 31st March, 2018

3. Bank Reconciliation Statement

as on 30th Sep., 2016

4. BANK RECONCILIATION STATEMENT

Case Study Answer-

1. Answer:

1. (c) Both (a) and (b)

2. (d) All of the above

3. (c) Both (a) and (b)

4. (a) To match the balances as it is generally experienced that when a comparison is made between

the bank balance as shown in the firm’s cash book and the bank statement, the two balances do not tally.

5. (b) False

2. Answer:

1. (a) timing differences in recording of transactions.

2. (a) balance in cash book greater than the balance of pass book.

3. (b) deducted from debit balance of cash book.

4. (a) added to debit balance of cash book.

5. (a) ₹ 4,33,980