Important Questions

Multiple Choice Questions-

Q1. On dishonor of a discounted bill whom does the bank look for payment

(a) Drawer

(b) Drawee

(c) Endorser

(d) Payee

Q2. Noting charges are ultimately borne by –

(a) Drawee

(b) Drawer

(c) Payee

(d) Maker

Q3. A Promissory note …………… the acceptance

(a) Does not require

(b) Requires

(c) Makes

(d) Arranges

Q4. B has accepted the bill drawn on him by A. Which of the following statements is correct?

(a) A can endorse the bill, B cannot endorse the bill

(b) A can endorse the bill

(c) B cannot endorse the bill

(d) B can endorse the bill

Q5. At the time of renewal of a bill, ……………. account is debited in the books of the drawee.

(a) Interest

(b) Discount

(c) Rebate

(d) None of the options

Q6. A bill of Rs. 5,000 is discounted with the banker for RS. 4,750. The bill is dishonored

at maturity. The drawee pays 60% of his acceptance. What is the amount of bad debts?

(a) Rs. 2,000

(b) Rs. 2100

(c) Rs. 1900

(d) Rs. 1800

Q7. Refusal by the acceptor to pay the bill on the maturity date is called –

(a) Dishonor of bill

(b) Retirement of bill

(c) Rebate on bill

(d) Discounting of bill

Q8. Find the due date of a bill of exchange dated 9th December, 2007, payable after 45 days.

(a) 25th January, 2008

(b) 24th January, 2008

(c) 26th January, 2008

(d) 27th January, 20008

Q9 The party which is ordered to pay the amount is known as –

(a) Drawee

(b) Payee

(c) Drawer

(d) None of the options

Q10. Three days are added for ascertaining the date of maturity. These are known as days of-

(a) Grace

(b) Maturity

(c) Payment

(d) None of the options

Very Short-

1. Is bill of exchange drawn by the debtor?

2. Does promissory note require acceptance?

3. What is the date of maturity of a bill of exchange?

4. What is the date of maturity of a bill of exchange? Calculate the due date of a bill of exchange

written on July 13, 2017, for 30 days.

5.What is noting of the bill of exchange?

6. If the acceptor of the bill refuses to pay the bill on maturity, what is it called?

7. What are the two most used negotiable instrument.

8. What is the bill of exchange?

Short Questions-

1. Explain the characteristics of the bill of exchange?

2. If the acceptor of the bill refuses to pay the bill on maturity, what is it called?

3. Name any two types of commonly used negotiable instruments.

4. What is noting of a bill of exchange?

5. Explain briefly the procedure of calculating the date of maturity of a bill of exchange. Give example.

Long Questions-

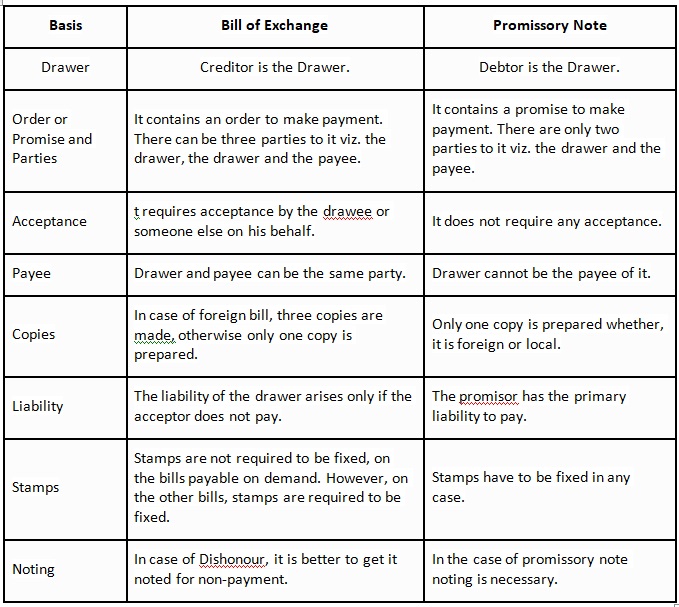

1. Differentiate between bill of exchange and a promissory note.

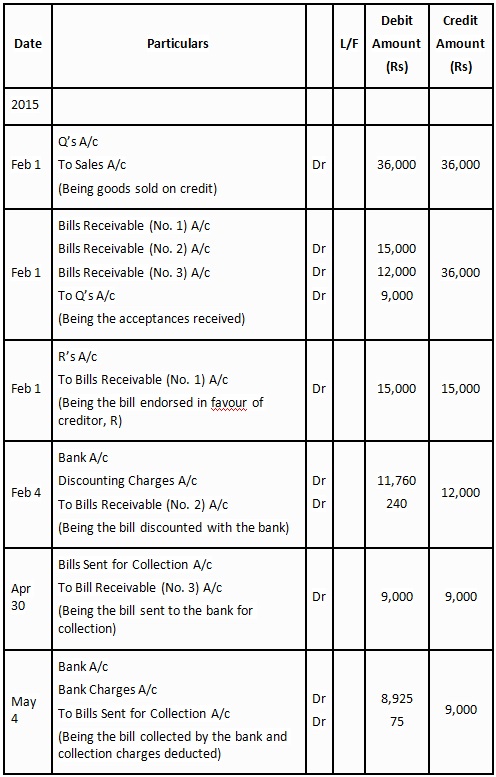

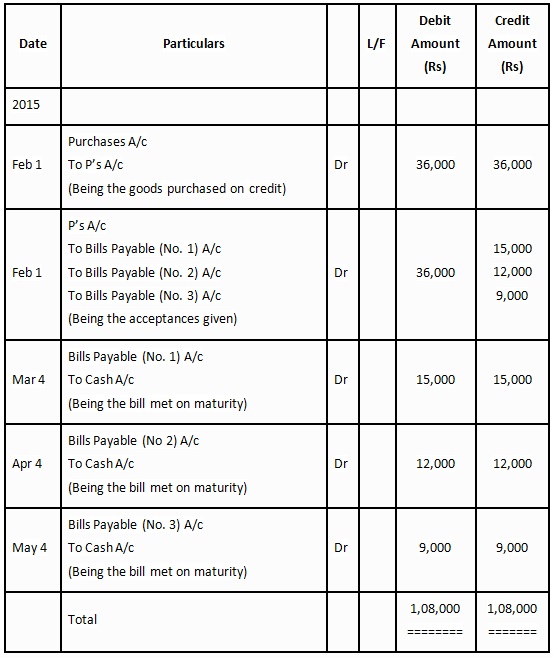

2. P draws on Q three bills of exchange for Rs. 15,000, Rs. 12,000 and Rs. 9,000 respectively for

goods sold to him on 1st February, 2013. These bills were for a month, 2 months and 3 months,

respectively The first bill was endorsed to his creditor R. The second bill was discounted with his

bank on 4th February 2013 @12% per annum discount and the third bill was sent to his bank for

collection on 30th April. On the due dates, all the bills were duly met by Q. The bank sent the collection

advice for the third bill after deducting Rs. 75 as collection charges. Pass the journal entries in the books

of P and Q.

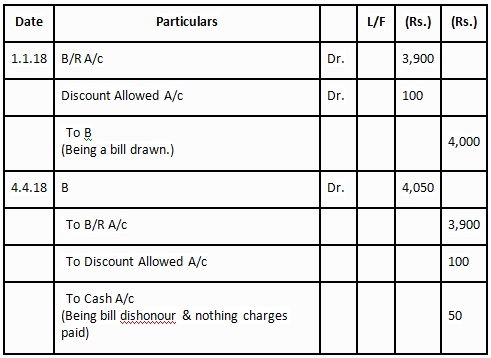

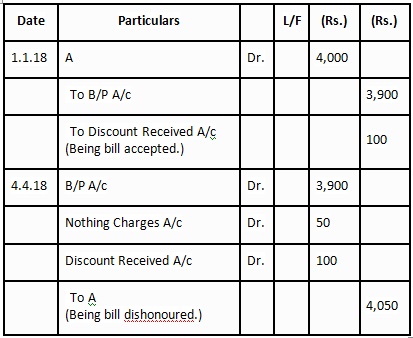

3. B owes A Rs.4,000 on 1st January 2018. B accepts a three mont is bill for Rs.3,900 being in full

settlement of the claim. At its due date the bill is dishonoured. Noting charges Rs.50 are paid by A.

Give the Journal Entries in the books of A and B.

Case Study Based Question-

Read the following hypothetical text and answer the given questions: -

On 1st January 2018, Sushil drew on Parag, who is a debtor for ₹15,000 three bills of exchange: 1st: for

₹4,000 at one month, 2nd: for ₹5,000 at two months and 3rd: for ₹6,000 at three months.

Parag accepted all three bills. On 10th January 2018, Sushil endorsed the first bill to his creditor Anand

in full settlement of his account of ₹4,120. This bill was duly met on maturity.

On 20th January 2018, the second bill was discounted from the bank for ₹4,850. This bill was dishonoured

on the due date and the bank paid ₹40 as nothing. On Parag’s request Sushil drew a fourth bill on Parag for

2 months for the amount due plus ₹200 as interest.

Third bill was paid under a rebate of 15% p.a. one month before maturity. The fourth bill was sent to the bank

for collection on 4th May 2018 and was duly met on maturity.

Questions:

1. What is the due date for the Second Bill of Exchange?

(a) March 1, 2018

(b) March 2, 2018

(c) March 3, 2018

(d) March 4, 2018

2. What will be the journal entry for the bill endorsed by Sushil to Anand in the books of Sushil?

(a) Anand Dr. 4,000

To Bills Receivables (I) A/c 4,000

(Being bill endorsed to Anand for the full settlement of his account)

(b) Anand Dr. 4,120

To Discount Received A/c 120

To Bills Receivable (I) A/c 4,000

(Being bill endorsed to Anand for the full settlement of his account)

(c)Anand Dr. 4,120

To Discount Received A/c 120

To Parag 4,000

(Being bill endorsed to Anand for the full settlement of his account)

(d) No Entry will be done in the books of Sushil.

Read the following hypothetical text and answer the given questions: -

On 1st January 2017, Pravin sold goods to Navin for ₹ 1,00,000 received ₹ 25,000 in cash and drew two

bills, first for ₹ 45,000 and second for ₹ 30,000 for two months each. Both the bills are duly accepted by

Navin. First bill was endorsed to Shobha in settlement of her account of ₹ 45,500 and second bill was discounted

from the Bank @ 12% p.a. On the due date of these bills, both bills were dishonoured. Shobha has paid ₹ 100

and Bank has paid `80 as Noting charges. Navin paid ₹ 20,000 and Noting charges in Cash and accepted a new

bill for the balance at three months. The interest on balance @ 18% p.a. was paid in cash. The new bill is immediately

endorsed to Jayesh. On the due date of the new bill, Navin became insolvent and nothing was recovered from the estate.

Questions:

1. What will be the journal entry in the books of Pravin for the first bill endorsed to Shobha dishonoured?

(a) Navin Dr. 45,100

Discount Received A/c 500

To Shobha 45,600

(Being first bill dishonoured and noting charges payable and the discountreceived account written of)

(b) Navin Dr. 45,100

To Sobha 45,100

(Being first bill dishonoured and noting charges payable written of)

(c) Navin Dr. 45,600

To Discount Received A/c 500

To Sobha 45,100

(Being first bill dishonoured and noting charges payable and the discount received account written of)

(d). No Entry will be done in the books of Sushil.

2. What will be the journal entry for the bill accepted for the payment to be made to Praveen in the books of Navin?

(a) Bills Receivable A/c (I) Dr. 45,000

Bills Receivables A/c (II) Dr. 30,000

To Pravin 75,000

(Being acceptance given to Pravin for the two bills)

(b) Navin Dr. 75,000

To Bills Receivable (I) A/c 45,000

To Bills Receivable (II) A/c 30,000

(Being acceptance given to Pravin for the two bills)

(c) Navin Dr. 75,000

To Bills Payable (I) A/c 45,000

To Bills Payable (II) A/c 30,000

(Being acceptance given to Pravin for the two bills)

D. No Entry will be done in the books of Sushil.

Answer key

MCQ Answers-

1. Answer: (a) Drawer

2. Answer: Drawee

3. Answer: (a) Does not require

4. Answer: A can endorse the bill, B cannot endorse the bill

5. Answer: (a) Interest

6. Answer: (a) Rs. 2,000

7. Answer: (a) Dishonor of bill

8. Answer: (a) 25th January, 2008

9. Answer: (a) Drawee

10. Answer: (a) Grace

Very Short Answers-

1. Ans. No the bill of exchange is not drawn by a debtor.

2. Ans. No, the promissory note does not require acceptance.

3. Ans.The date of maturity of a bill of exchange is the date on which the bill becomes due for payment.

4. Ans. The date of maturity will be August 14, 2017.

5. Ans.Noting is referred to the recording of the fact of dishonour by a notary public.

6. Ans. In situations where the acceptor refuses or is not in a position to pay, such a condition causes breach

of promise and leads to dishonour of bill.

7. The two most used negotiable instrument is.

• Bill of exchange

• Promissory Note

8. Bil of exchange is a written document signed by the head of the department or the makers guiding them

to pay a certain amount for the order of a certain individual or the bearer of the device.

Short Answers-

1. The characteristics of the bill of exchange are.

A bill of exchange should be in writing

The order must be unconditional

The date of payment must be a fixed date

It should be signed by the drawee of the bill

It should be signed by the drawer of the bill

2. Ans. In case the acceptor refuses or not in a position to pay the bill then it is considered as the breach

of the promise made at the time of the acceptance and is called dishonour of the bill.

3. Ans. A Negotiable instrument means a promissory note, bill of exchange or cheque either to order or

bearer.” Two negotiable instruments are bills of exchange and promissory notes.

4. Noting of a Bill means getting the Bill notified and presented on its dishonour with the Notary Public.

5. Ans. Maturity refers to the date on which a bill of exchange or promissory notebecomes due for payment.

In arriving at the maturity date 3 days, known as days of grace must be added to the date on which the period

of credit expires.

However, where the date of maturity is a public holiday e.g. all Sundays, 15 August etc., the instrument will

become due on the preceding business day. But when an emergency holiday is declared under the Negotiable

Instruments Act, 1881, which happens to be the date of maturity of a bill of exchange, then the date of maturity

will be the next working day immediately after the holiday. Example: If a bill of Rs 2 lacs is drawn on 1stSept.

2008, payable after three months, then the due date or nominal date is 1stDec. 2008 while the bill is legally due

on 4th Dec. 2008.

Long Answers-

1. Answer: The difference between a bill of exchange and promissory note are as follows:

2. Answer: P’s JOURNAL

3. Answer

BOOKS OF A

JOURNAL ENTRIES

BOOKS OF B

JOURNAL ENTRIES

Case Study Answer-

1. Answer:

1.

Solution: Due Date of Bill = Date of Bill Drawn + Period + Grace Days.

2. (b)

Solution: Journal entry for the bill endorsed by Sushil to Anand in the books of Sushil is

Anand Dr. 4,120

To Discount Received A/c 120

To Bills Receivable (I) A/c 4,000

(Being bill endorsed to Anand for the full settlement of his account)

2. Answer:

1. (a)

Solution: Journal entry in the books of Pravin for the first bill endorsed to Shobha dishonoured is

Navin Dr. 45,100

Discount Received A/c 500

To Shobha 45,600

(Being first bill dishonoured and noting charges payable and the discount received account written of)

2. (c)

Solution: Journal entry for the bill accepted for the payment to be made to Praveen in the books of Navin is

Navin Dr. 75,000

To Bills Payable (I) A/c 45,000

To Bills Payable (II) A/c 30,000

(Being acceptance given to Pravin for the two bills)